Finance and Contract Management between them were remarkably successful at ensuring compliance indeed ultimately they had 100 compliance because they ensured the collapse of that segment of the business. Any person or business thats run into trouble with the IRS or had their tax return denied or audited can confirm the critical importance of tax compliance.

The Informal Sector The Implicit Social Contract The Willingness To Pay Taxes And Tax Compliance In Zimbabwe

For contract professionals who are actively taking steps to be compliant in their overseas assignments the increasing use of digital in tax processes does also present a risk.

Tax compliance and contracting most. This means that for every 10000 earned up until the 100000 threshold the employee pays 332 less in tax than the contractor. For those looking for opportunities overseas or delivering on global projects from your home country the world of compliance can be a real minefield and individual circumstances can impact your determination in different locations. Businesses and their service providers need to acknowledge that tax compliance change is a systemic issue and therefore maintenance needs to be addressed systematically.

Tax compliance self assessment system and tax administration. A strong tax governance framework leverages the tax function as a true strategic business partner actively involved in the identification and implementation of requirements and regularly collaborating with compliance teams and affected. Beyond timely accurate compliance services we advise clients on the following.

Examining the risks and challenges presented by foreign and domestic tax laws to minimize cross-border disputes. Taxpayer surveys may be able to capture a representative sample of the population but they rely. Anzeige Dieses und viele weitere Bcher im Thalia Onlineshop finden bestellen.

These steps include maintaining the proper forms for each employee withholding and filing taxes using the correct tax codes for the business collecting and filing garnishments observing federal and state overtime rules. Payroll compliance refers to the steps every employer must take to abide by the tax regulations wage and hour rules and other applicable requirements related to payroll. In-Depth Analysis from In-Country Experts Practice Tools Global News.

Anzeige Bloomberg Tax is a Comprehensive Global Compliance Resource. The implications of outsourcing tax compliance particularly in a global company reach far beyond the tax department. Additionally the BDO Knowledge Tax Webinar Series provides insight and perspective on the tax issues most important to clients.

As day-to-day tax operations enabling compliance with both new obligations and ongoing requirements. There are 6 phases to compliance maintenance. Each member of our consulting group is an experienced government contracting professional with backgrounds in areas such as government accounting the FAR Part 31 cost principles business systems and contract and subcontract management.

This is the basis. In-Depth Analysis from In-Country Experts Practice Tools Global News. A minor reporting or administration error will be much easier to identify where technology is being utilised by tax authorities.

In addition to improving tax compliance tax operations and tax risk management an effective outsourcing arrangement can provide the impetus for tax transformation efforts especially in repositioning tax to partner more effectively with the C-suite the board and the. Tax compliance work goes hand in hand with other tax advisory services to bring you a comprehensive approach to international tax planning. Gender ethnicity differences of Malaysian taxpay ers.

Combining that with corporation tax at 19 creates an effective marginal tax rate of 453 31 higher than that of the employee. For contractors working internationally tax compliance is crucial in order to prevent potential fines or legal action. Anzeige Dieses und viele weitere Bcher im Thalia Onlineshop finden bestellen.

Measuring tax compliance and evaluating its determinants is challenging in any context. Tax compliance attitude and behavior. Journal of Finance and Management in Public Services 22 27 42.

So when we talk about compliance we must define its role and the responsibilities of compliance managers very carefully. Effective tax planning can be critical to helping government contractors moderate tax liability and optimize profits in a highly competitive landscape. Anzeige Bloomberg Tax is a Comprehensive Global Compliance Resource.

The contractors dividend distributions are now taxed at 325. Bill Define Director of Tax Compliance and Contracting will be the first to admit that the name of his office sounds a bit dry and technical and perhaps not the most exciting position at UVA. Maintaining tax compliance is a systematic cycle of six steps.

A basic example here is the annual April deadline for tax. What is Tax Compliance. Overall tax compliance involves being aware of and observing the state federal and international tax laws and requirements set forth by government officials and other taxing authorities.

Examining these issues in developing countries is particularly difficult due to the large size of the informal sector. They know first-hand the challenges you face and the type of assistance that would be most helpful to you. People hear taxes and contracts and they think Wow Im glad thats somebody else job he laughed.

The Malaysian Accountant 1 7.

Tax Compliance Research Methods And Decision Processes Springerlink

Pin On Informacion Medica En Espanol

Https Www Un Org Development Desa Financing Sites Www Un Org Development Desa Financing Files 2020 10 Crp51 20extractive Psc 10 10 2020 Pdf

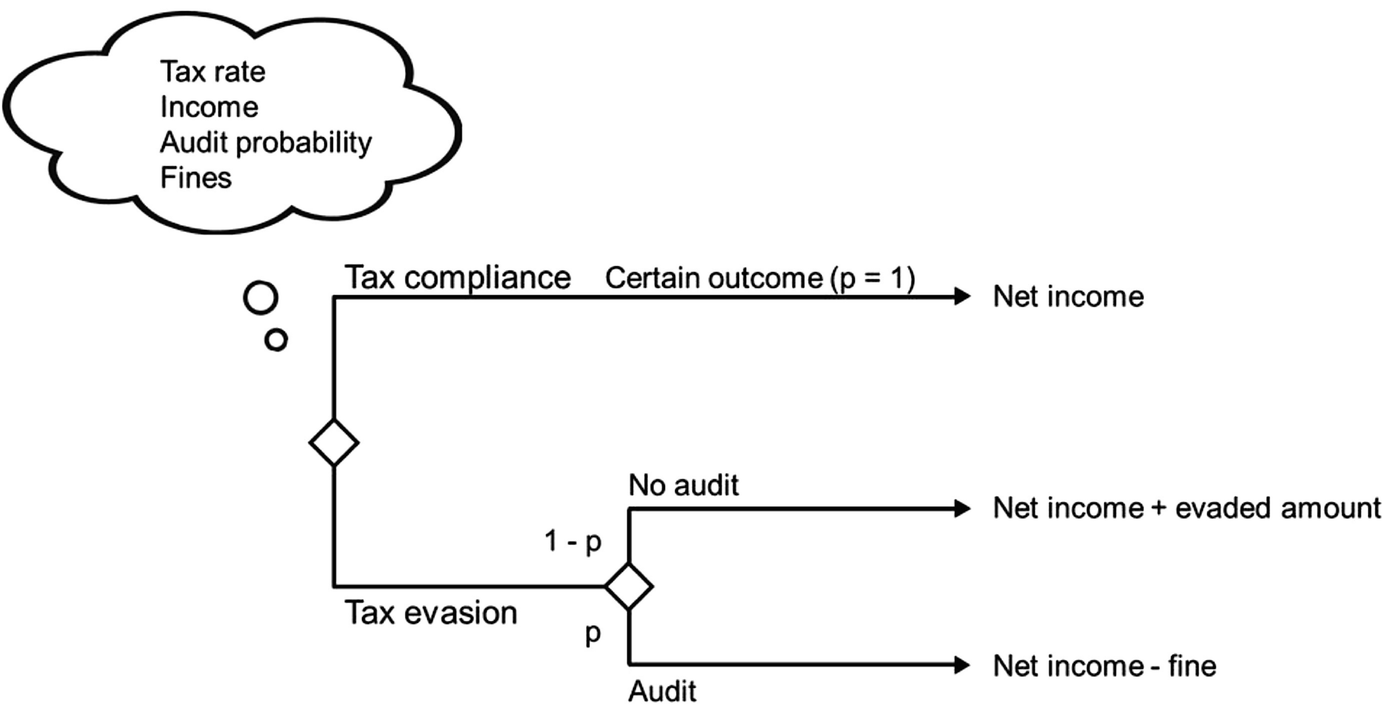

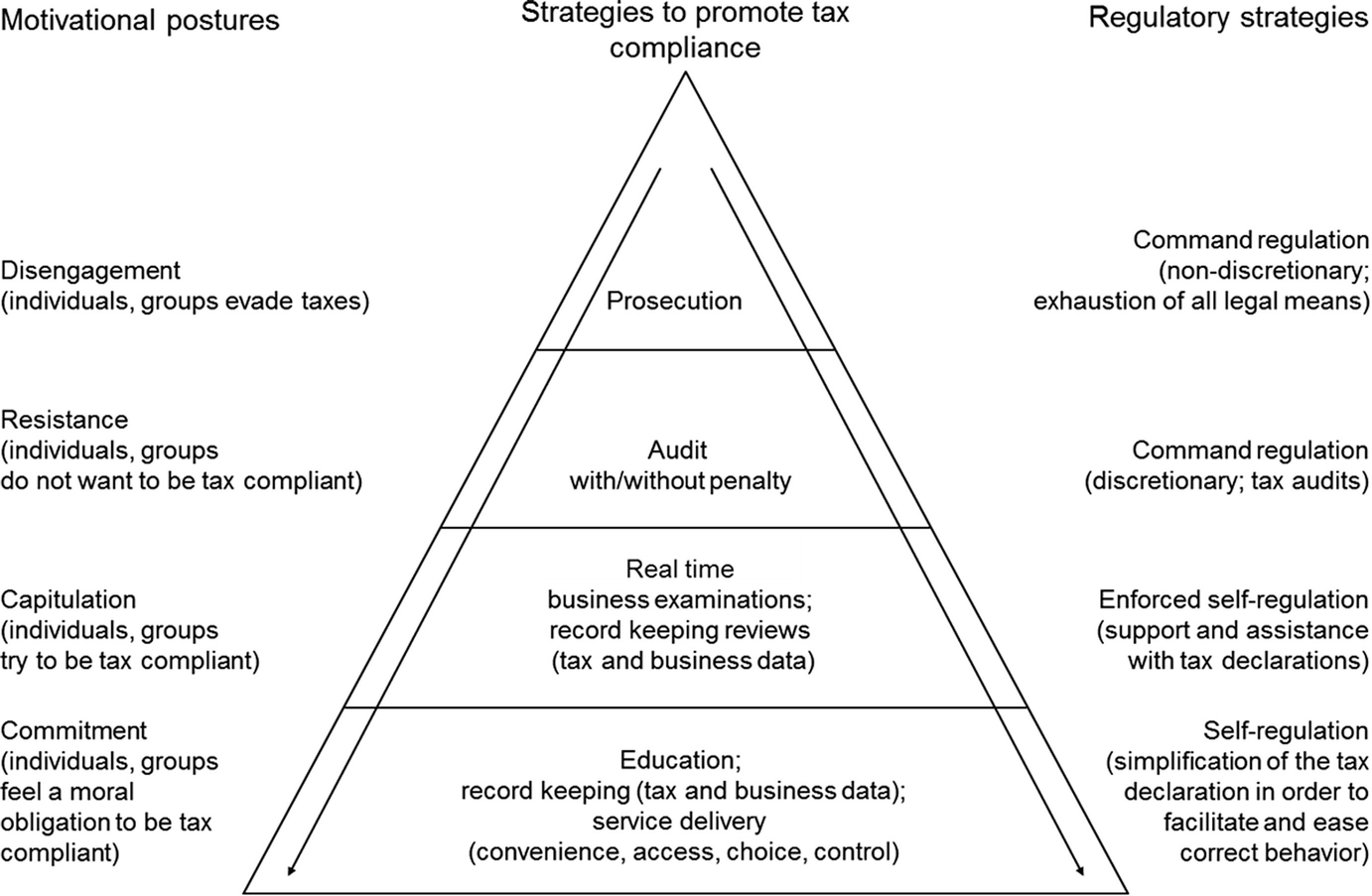

The Informal Sector The Implicit Social Contract The Willingness To Pay Taxes And Tax Compliance In Zimbabwe

The Informal Sector The Implicit Social Contract The Willingness To Pay Taxes And Tax Compliance In Zimbabwe

Tax Compliance Research Methods And Decision Processes Springerlink

Contract And Commercial Management Survey Deloitte Us

Understanding Of Sap Contracts Management Sap Blogs

Understanding Of Sap Contracts Management Sap Blogs

Accounting Word Cloud Word Bubble Tags Vector Stock Vector

Tax Rates In Germany Income Tax And Tax Brackets

The Informal Sector The Implicit Social Contract The Willingness To Pay Taxes And Tax Compliance In Zimbabwe

The Informal Sector The Implicit Social Contract The Willingness To Pay Taxes And Tax Compliance In Zimbabwe

Tax Rates In Germany Income Tax And Tax Brackets

The Informal Sector The Implicit Social Contract The Willingness To Pay Taxes And Tax Compliance In Zimbabwe

The Burden Of Accounting And Taxes On Small Business Small Business Accounting Small Business Management Business Tax