18 Dec 2014 GST treatment of ATM service fees credit card and debit card surcharges - GSTR 20142 On 17 December 2014 the ATO issued GST Ruling GSTR 20142 entitled Goods and services tax. Credit card users would know that before GST there was no Service Tax levied on the payment of utility bills.

Cost Of Compliance Will Increase Because Of Improper Gst Implementation Improper Increase Traffic Increase

This is an increase of 3 percent.

Credit card what are changes after gst. The GST payable on the supply will therefore be 523 which is 111 of the GST inclusive price of the cleaning products plus the 111 of the 50 of the 5 credit card surcharge. Bank fees interest dont attract GST as they are a financial service. The total interest you pay in 6 months is Rs.

Your cards bonus categories should align with your spending to make it worthwhile. Currently there is a RM50 service tax on principal card holder and RM25 service tax on supplementary card holder. On 05 August 2017 what will i do when gst registration application are cancelled by authority after submission of document required are insufficient i have not submitted rent agreement but submitted license of local authority.

Before the introduction of GST all credit card services incurred service tax at 15 but now this service tax. To help low-moderate income families offset the burden of this additional taxation the federal government provides a credit. Over here we are talking about the service tax and annual fee.

Status showing Pending for Processing. Anytime your credit card changes its rewards rate you should compare the new rate to your budget to make sure you can still earn a good amount of points or cash back. Credit Cardholders use their cards in purchasing the things they like and repay the amount within a.

After 1 April 2015 this service tax will be abolished due to the implementation of GST. Credit cards are one of the most popular financial products among the users and since the implementation of GST there are a number of users who are having several doubts related to it. Lets say if you have purchased something on a 6 month EMI using your Credit Card.

The tax will be based on the overall interest accruing on the same. Using credit cards irresponsibly or making common mistakes can cost you a lot of money both now and in the future. Service tax was charged at 15 on card fees EMIs interest late fees processing charges etc.

Credit card transactions will undoubtedly be covered under GST and it would be applicable on late credit card payments interest rate and processing fee. Service tax was mainly applicable on the interest charged on the transactions made by the cards in the pre-GST era. To be clear these surcharges should not be confused with the credit card charges levied by the banks on their customers.

All credit card services incur GST at 18. The GSTHST credit is a tax-free payment that is paid out quarterly to eligible individuals. See for paying GST you need to create a challan via GST portal after you log in.

GST is levied at 18 percent whereas Service Tax was earlier levied at 15 percent. Similarly now GST would be applicable on all these items instead of service tax. Once the Taxpayer is logged in to the GST portal he will be able to see his dashboard.

On 22 July 2017 I have registered as on 110717 but i have not received GSTIN till now almost 12 days spend. The 18 GST tax rate will apply to those having a revolving credit to pay. The supermarket imposes a surcharge of 5 if payment is made using a credit card.

HDFC SBI Bank of Boroda and few more. For credit card holders there is confusion on how GST is being charged. Then you have a list of banks of whose payment they will accept via debit card and NEFT.

They are characterised as exempt supplies under the Goods and Services Tax Act. Paying late just may be the worst thing you can do for your credit score. 532 whereas the EMI processing fee.

Dr Hasmukh Adhia. The Taxpayer can generate a GST challan by clicking Services Payments Create Challan. It was previously released in draft form as GSTR 2014D2.

The Taxpayer will login to GST website by entering his Username and Password. Good and Services Tax GST or Harmonized Sales Tax HST is levied when you pay for most goods and services in Canada. Same treatment for both Merchant Customer.

1 Paying Late. 7 banks debit card has been allowed. GST will increase my credit card bills.

Treatment of ATM service fees credit card surcharges and debit card surcharges. Credit Card Surcharges GST Inland Revenue have been asked about their position on credit card surcharges GST. Process Flow to pay GST through HDFC Payment Gateway using Credit Card Debit Card Step 1.

If you are falling for any of these credit mistakes you could be hurting your finances and causing yourself a lot of problems. The constant default in payment of the bills can lead to such a situation. 12 A wrong message is doing rounds on social media that if u make payment of utility bills by credit cardsyou will be paying GST twice.

The Overall Understanding Of Gst Project Cover Page Goods And Services Quickbooks

How To Gst Economic Growth In India Indian Economy Economic Growth Economy

Pin By Chartered Accountant In Bangal On Gst Bank Account Portal Refund

Online Gst Registration Process In India Tradenfill Online Taxes Registration Aadhar Card

Gst Credit Card Bill Insurance Premium To Get Costlier Insurance Card Insurance Card Template Car Insurance

Centre Clears The Air On Gst Dues Goods And Services Goods And Service Tax Standard Operating Procedure

The Much Awaited 38th Gst Council Meeting Is Set To Get Its Stage On 18th December 2019 The Gst Council Will Be Chaired Industry Sectors Indirect Tax Finance

Types Of Gst Goods And Service Tax Goods And Services Indirect Tax

What Is Gst Gst Is A Comprehensive Value Added Tax On Goods And Services It Is Collected On Value Added A Goods And Services Study Materials Value Added Tax

Good Service Tax Gst Concept With Fina Free Vector Freepik Freevector Background Business Marketing Design Social Media Banners Cinema 4d Animation

Apply Gst Registration Goods And Services Goods And Service Tax Business Bank Account

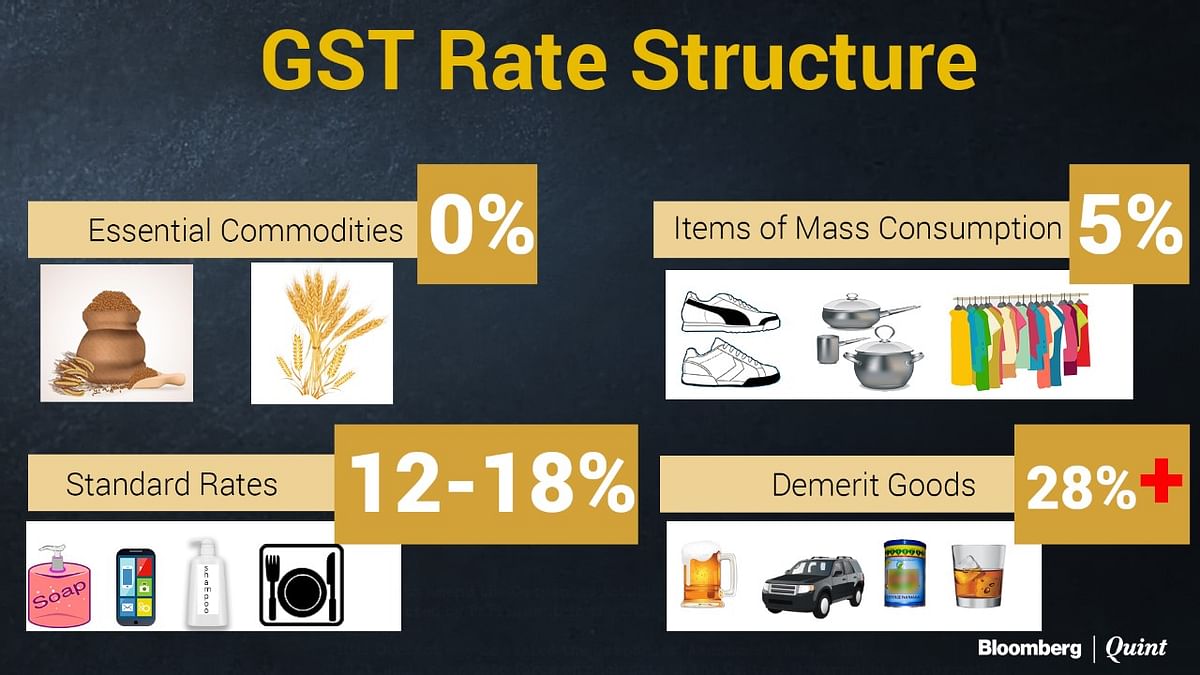

India Gst The Four Tier Tax Structure Of Gst

Here Is Detailed Infographic On The Gst And Its Impact On Various Sectors In India You Can Also Find Answers Related Marketing System Business Finance Finance

All About Gst Composition Scheme 1 3 Turnover Limit Input Credit Returns Faq Chartered Accountants Composition Schemes

A Comprehensive Software To Manage All Your Gst Billing Compliance Needs File Your Gstr1 Gstr3b Now Filing Is Ju Tax Software Income Tax Return Income Tax

Know About Types Of Gst Returns And File Your Return Under The Desired Categoriy Timely Timley Gst Return Filing Gi Credit Card Design Card Design Credit Card