The Federal Reserve recently approved its third interest rate increase of the year and that is both good and concerning news for banks. Find a Financial Advisor.

Fed Rate Hikes Map Investing Rhetoric Investing Financial News

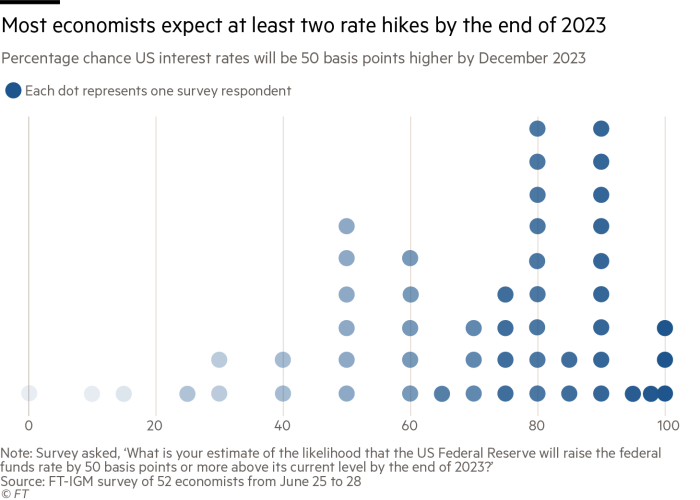

Economists see first Fed rate hike in 2023.

Us fed rate hike good or bad how is it. The Fed isnt in charge of that politicians and businesspeople are and we need to cut the morphine drip of. In the past many companies have raised US-denominated debts at cheap rates. Beyond the obvious impact on borrowers and credit card holders higher borrowing costs can ripple through the rest of the economy including to your investments.

There have been times in history when the nations benchmark rate was increased well above that range in order to curb runaway inflation. If youre concerned about what an additional increase in the Feds benchmark rate will mean for your mortgage or credit card as well as student debt home equity loan and car payment heres a. In October 2017 the Fed took the extra step of quantitative tightening.

A Fed rate hike invariably leads to an increase in the prime lending rate which often leads to an increase in interest rates for both consumers and businesses. The financial world is eagerly anticipating the US. See our piece below from August 2015 for more details.

Receive full access. In fact the Feds December rate guidance and Powells comment that the balance sheet roll off was on autopilot is largely what caused the SP 500 to plunge to its December 24th lows 198 from the September 20th high. Since the Feds first hike in mid-December 2015 its upped rates six more times with another.

Federal Reserve meeting in September in the expectation that the central bank may finally raise interest rates for the first time in about eight years. On the plus side higher rates. That only happens at the ground level.

3 Reasons That a Fed Rate Hike Would Be Bad News. The rate hike however small adds another mildly bearish element to the global crude market by strengthening the dollar. Yet as Juckes points out its not obvious that Fed rate hikes have boosted the dollar.

The Federal Reserve tends to keep the fed funds rate within a 20 to 50 sweet spot that maintains a healthy economy but there are exceptions. The odds are against a rate hike although Fed officials have signaled differently about their preferences. Even so three-quarters of the economists forecast the central bank will have to raise rates by the end of 2023 where the median respondent has.

Well investors prayers have been answered and the Fed has announced its steady rate hike plan is done with. In other words the Fed had tapered back to 0 in additional assets every month and it was now tapering into negative territory. The gradual hike in Fed rates will also make the international debt more expensive.

Borrowing money will cost more when rates go up but interest paid by banks will climb as well. Federal Reserve will be good news for the world because they will show its largest economy is in good. Expensive international debt.

FRANKFURT Reuters - Further interest rate hikes by the US. The Fed was no longer adding assets to its balance sheet every month and it then decided to reduce the assets it held every month. If its a single quarter-point rate hike and you slept through Wednesday you wouldnt even notice.

It also has dipped well below 2 to stimulate economic growth.

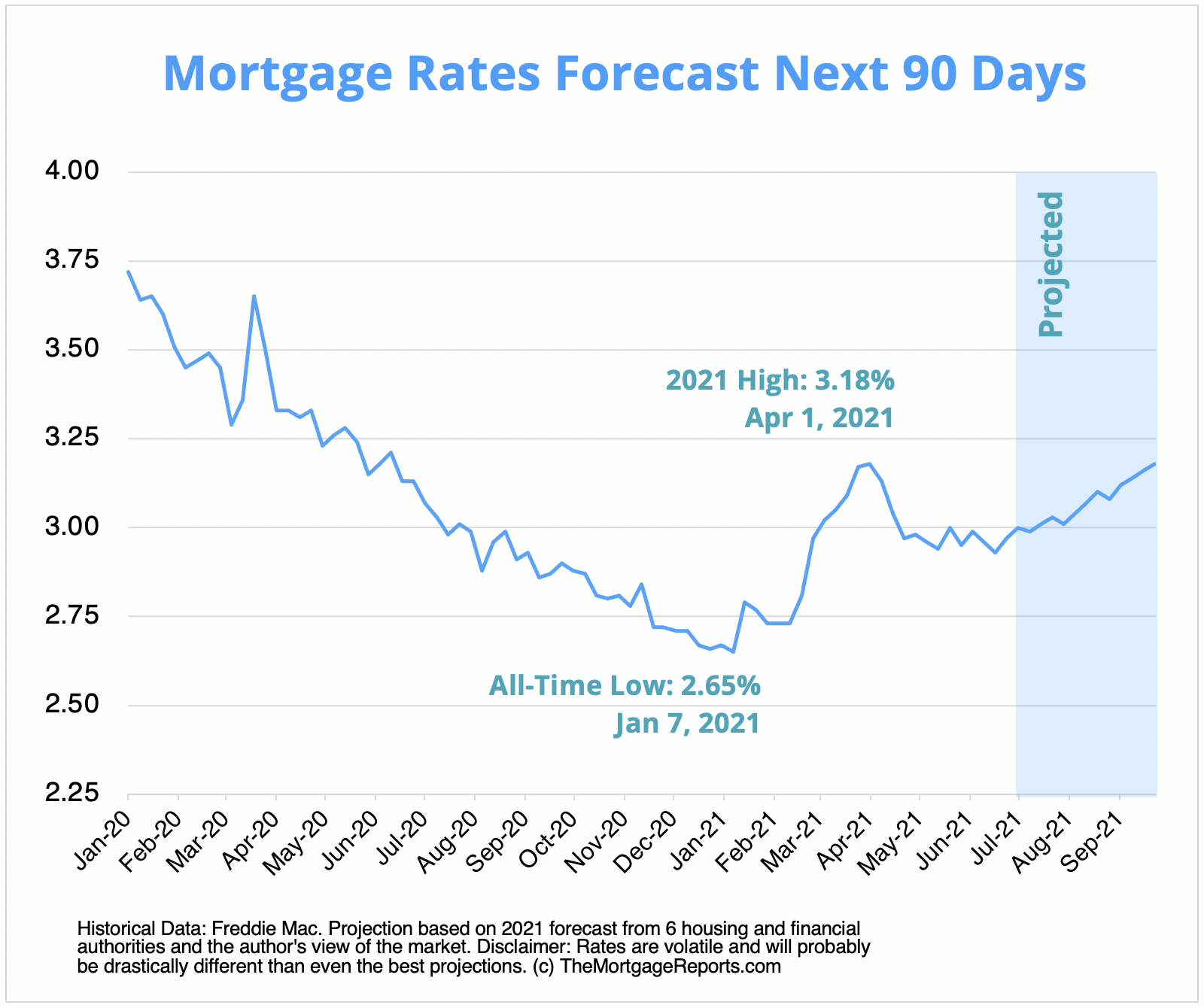

Mortgage Interest Rates Forecast Will Rates Go Down In July

Mymoneykarma Com Provide Home Loans At Low Interest Rate In Hyderabad Visit Us And Compare 50 Banks And Their Offerings Hu Low Interest Rate Home Loans Loan

How Do Interest Rates Affect The Stock Market

The Fed Moves Up Its Timeline For Rate Hikes As Inflation Rises

The Rising Level Of Interest Rates Just Keeps On Rising Loan Rates Interest Rates Bad Credit Mortgage

These Countries Offer The Highest Interest Rates Today Interest Rates Loan Interest Rates Best Interest Rates

How Do Interest Rates Affect The Stock Market

The Impact Of Interest Rate Changes By The Federal Reserve

Pin On Numerology September 2016

Yellen Rebuffs Pressure To Hike As Fed Gives Economy Room To Run Economy Forced Labor Running

Fed Experts Deliver The Bad News Productivity Slump Is For Real Bad News Productivity Productivity Growth

Here S How The Average Savings Account Interest Rate Compares To Yours Savings Account Interest Savings Account Bank Interest

Economists Predict At Least Two Us Interest Rate Rises By End Of 2023 Financial Times

The Decline In Long Term Interest Rates Needle Felted Owl Corporate Business Card Design Business Cards Creative

Opening Bell Stock Trading Trading Investing

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)