Calculating predetermined overhead rate can be done as follow. Based on this information the predetermined overhead rate is 25 per labor hour.

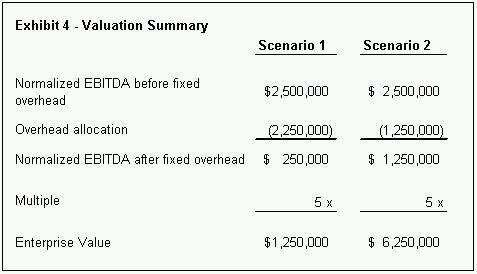

Allocation Of Fixed Overhead Costs Significant Impact On Value Corporate Commercial Law Canada

Calculating the Fixed Overhead Spending and Volume Variances Standish Company manufactures consumer products and provided the following information for the month of February.

The strategy of calculating overhead. You choose an. Predetermined overhead rate 500000 20000 hours 25 per direct labor. They make 800000 in monthly sales.

On 31 December 2016 the following estimates relate to ABC Ltd for the year ending 30 June 2017. The allocation rate calculation requires an activity level. Add up total overhead.

It is calculated us. Based on the review on the overhead cost in Birmingham motor production line the rate of each activity cost pool has been calculated in the table 1 below. From these the overhead rate equation is a matter of simple division.

Overhead Formula Operating Expenses Operating Income Taxable Net Interest Income 23000 115000 46000 23000 161000 1429. Under this method overhead absorption rate is found out by dividing the total overhead. This is when the system will accurately measure the various productas consumption of activities Hopper et al 2007.

To calculate the overhead rate per employee follow the steps below. Compute the total overheads of the business. A a b c a.

Add up estimated indirect materials indirect labor and all other product costs not included in. Divide the overhead costs by the number of billable hours. For a company to calculate overhead the most difficult task is to keep pristine records of cost and production.

Friday January 6 2017 The Strategy of Calculating Overhead Sara Tarkington uses these poker chips as an object lesson on FA when she teaches Brown Bag Sessions. Multiply that by 100 and your overhead. So it is calculated by dividing the total factory overhead cost by the total cost of direct materials used.

Heres a guide to getting an accurate costrevenue picture. Company As overhead percentage would be 120000 divided by 800000 which gives you 015. Setup 1000 setup hours 144000 Production scheduling 400 batches 60000 Production engineering 60 change orders 120000 Supervision 2000 direct labor hours 56000 Machine maintenance.

To get the final amount multiply the daily overhead rate by the number of delay days caused by the project owner. Using the overhead formula we get. Compute the overhead allocation rate.

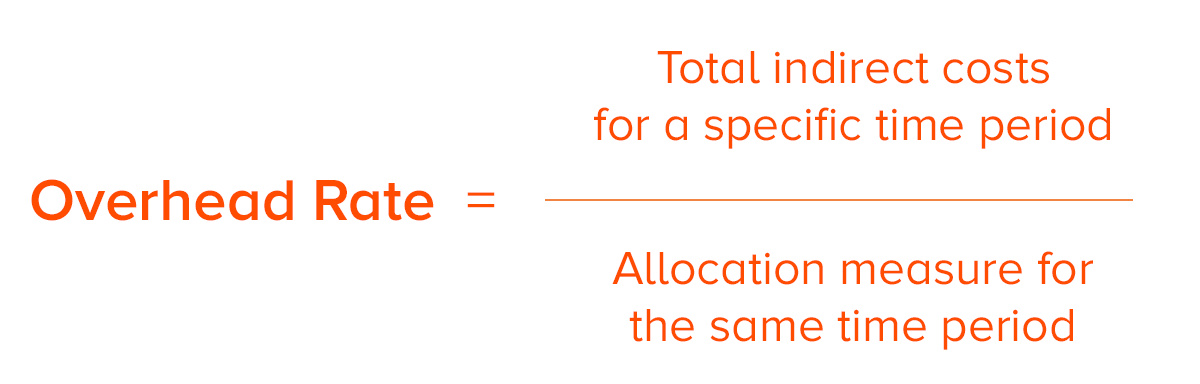

Remember that overhead allocation entails three steps. The absorption basis is most commonly units of a product labour hours or machine hours. The overhead absorption rate OAR is calculated as follows.

Activity cost drivers are chosen in third step. Calculating Overhead to Determine Profitability By Paul J. The blue chips represent Research the green chips are Instruction and the red ones are Public Service.

Im often asked how to determine overhead and specifically how to calculate overhead per attorney. Company A a consulting company calculates they have 120000 in monthly overhead costs. Calculate the predetermined overhead rate for Debion.

In the following example calculating the overhead rate for the material overheads is done by dividing the total overhead cost of 30000 by the calculation base of. General formula for calculating overhead absorption rate is as follows. Production overheads are usually calculated at the beginning of an accounting period in order to determine how much cost to assign a unit before calculating a selling price.

Debion uses normal costing and applies overhead on the basis of direct labor hours. To interpret this ratio of HoHey Restaurant we need to look at the ratios of other restaurants serving similar food and providing similar services. To calculate the daily contract overhead ratio divide contract overhead by the contract performance time by days Home Office Overhead.

Use the above data to calculate overheads to be absorbed to calculate total cost of the job by using six basis methods for overhead absorption. Daily Contract Overhead Rate. Calculating the Predetermined Overhead Rate Applying Overhead to Production At the beginning of the year Debion Company estimated the following.

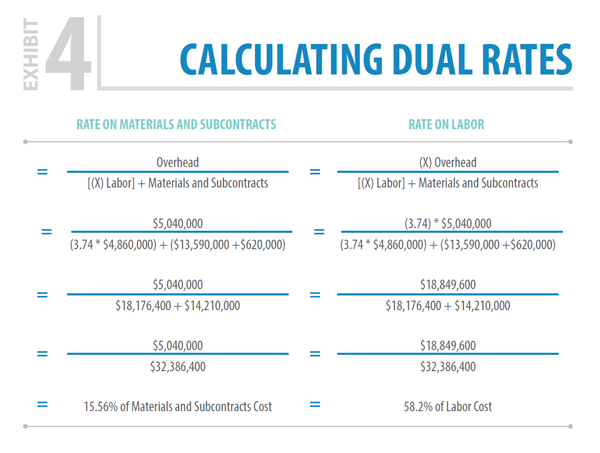

Overhead rate Overhead cost productivity labor hours labor cost machine hours etc. E18-21 Calculating Activity-based Costing Overhead Rates Assume that manufacturing overhead for Glassman Company in the previous exercise consisted of the following activities and costs. The product requires 2 hours of labor work so that it will require 50 of overhead 25 2 hours.

Calculate the labor cost which includes not just the weekly or hourly pay but also health benefits vacation pay. The sale is also expressed as a percentage. Can you truly measure how much each lawyer costs your firm and how much profit he or she generates.

C Percentage of Prime Cost Method. For the month of March direct labor hours were 7600. The overhead rate is calculated by adding your indirect costs and then dividing them by a specific measurement such as machine hours sales totals or.

Units produced 131000 Standard direct labor hours per unit 02 Standard fixed overhead rate per direct labor hour 230 Budgeted fixed overhead 64100 Actual fixed.

How To Calculate Overhead Costs In 2021 Overhead Construction Bids Leadership Strategies

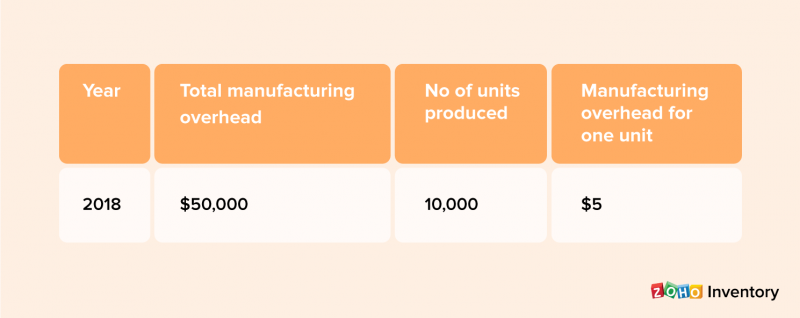

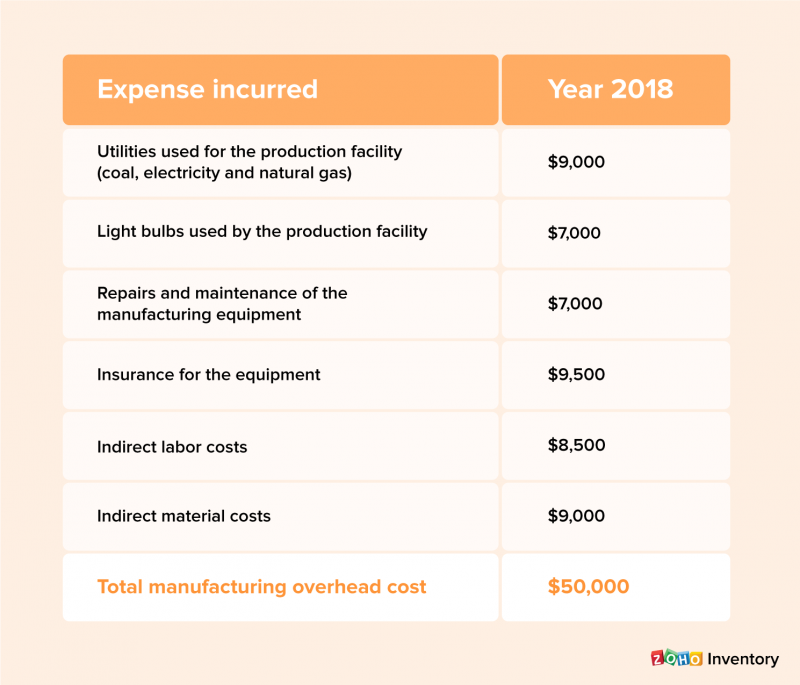

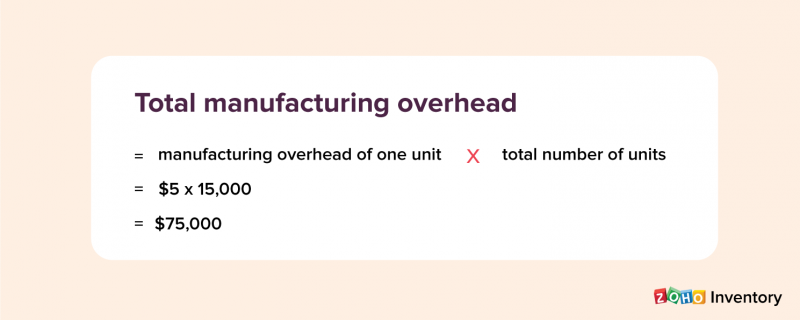

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho Inventory

-1.png)

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

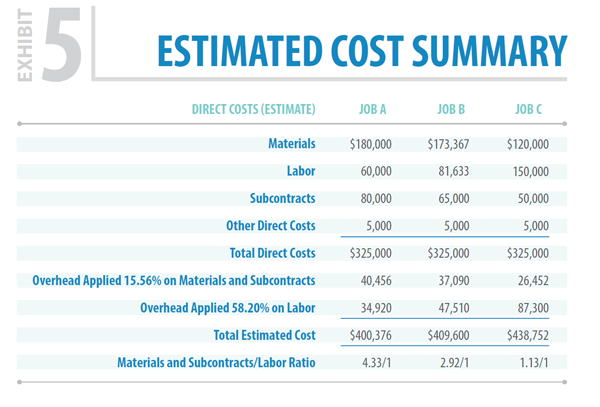

Pricing For Profit Contribution Margins In Construction Fmi

Pricing For Profit Contribution Margins In Construction Fmi

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

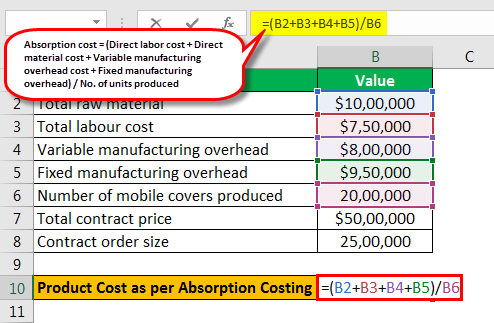

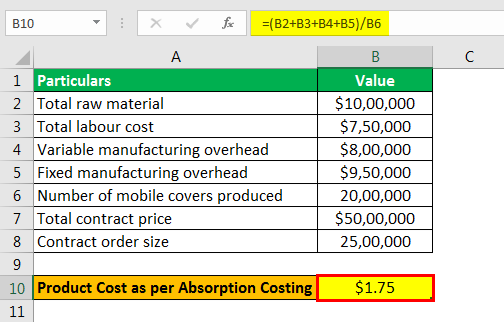

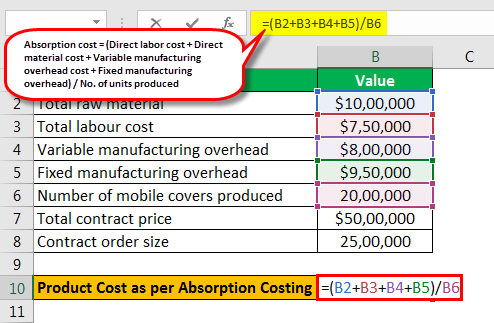

Absorption Costing Definition Formula How To Calculate

Absorption Costing Definition Formula How To Calculate

Overhead Expense Role In Cost Accounting And Business Strategy

Absorption Costing Definition Formula How To Calculate

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho Inventory

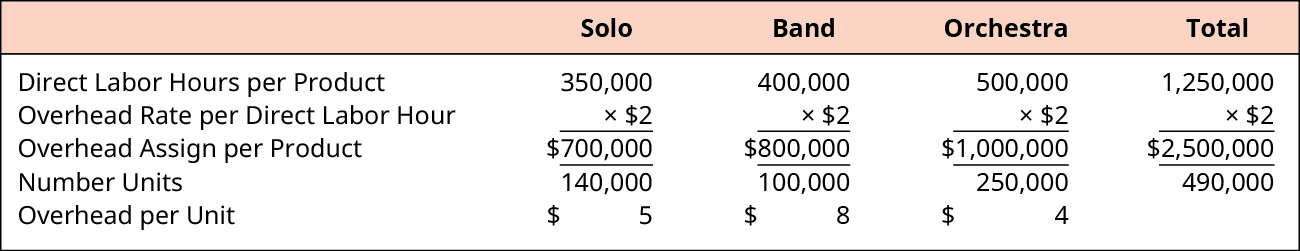

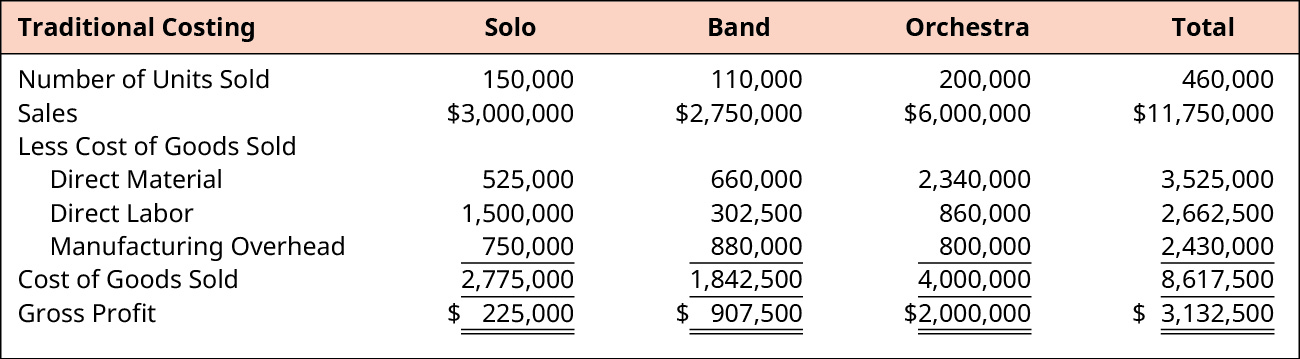

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

Overhead Expense Role In Cost Accounting And Business Strategy

9 Simple Steps To Calculating Menu Item Pricing Restaurant Manager

How To Calculate Reduce Restaurant Overhead Costs

Calculate Predetermined Overhead And Total Cost Under The Traditional Allocation Method Principles Of Accounting Volume 2 Managerial Accounting

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho Inventory