Here we would like to share the equity strategy written which we think is the most sought after reference for investors to strategize during this uncertain times. Below is the excerpt from the said report.

Morgans Global Equities platform manages 700 billion across US Equity 396bn International Equity 119bn and EMEA 184bn investment strategies.

Jp morgans equity strategy sept 2011. We believe perceptions of a US recession will continue to. We believe perceptions of a US recession will continue to. The Morgan Stanley International Equity Strategy invests in a diversified portfolio of companies that are primarily domiciled outside of the US.

A few examples of shareholders equity of a company include retained earnings paid in capital and. One of the consequences of the de-siloing has been strategically changing the country-specific sales model in Asia ex Japan for example instead of having a marketer focusing on institutional and retail in Taiwan both investor. JPMorgans European Equity Derivative Strategy Group uses a similar Cross Sectional Model.

The portfolio consists of a combination of high-quality companies characterized by high returns on operating. APPROACH Analyzes company prospects over the upcoming eight years. MSCI EAFE Net Index.

The reason for this is because the from an accounting perspective the balance sheet equation is Shareholders Equity Assets - Liabilities. Jp Morgan Asia Pacific Equity Research. We believe perceptions of a US recession will continue to.

JP Morgan also hired Kazuma Naito from Goldman Sachs in June 2011 to head up sales and marketing for equity derivatives in the region to help target key areas. The global fund has accumulated around 130 million in assets under management while the US fund has gathered 760m. Sam Riley Co-founder and CEO of Ansarada.

Enhanced index The new emerging markets fund provides similar risk characteristics as its performance benchmark the MSCI Emerging Market Index while seeking to provide an enhanced level return through incremental. Adding another cylinder to the engine. The US-listed suite also consists of ETFs targeting the US mid-cap US small-cap European international and emerging market.

FACT SHEET September 30 2020 JP. Morgans Equity Strategy Sept 2011 On Sept 7 JPMorgan came out a report titled Global Markets Outlook and Strategy. Sliding up the S curve.

Under normal circumstances the Fund invests at least 80 of its Assets in equity securities of US. Below is the excerpt from the said report. Morgan has been managing equity strategies for more than 30 years.

Please see Equity and Derivatives Markets Weekly Outlook 21 Nov 2005 for details on the European model. 350 Equity investment professionals with 13 average years of experience. In implementing this strategy the Fund primarily invests in the common stocks of US.

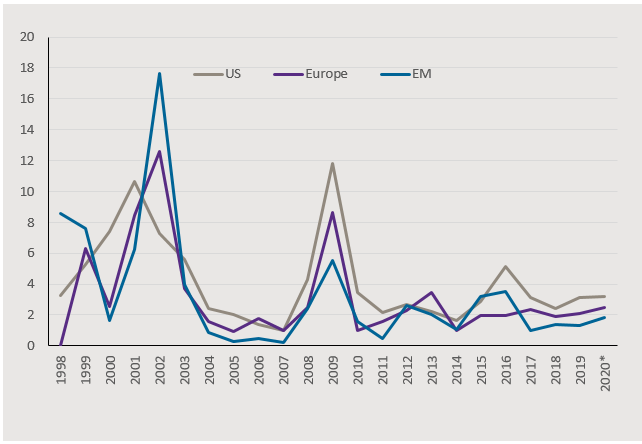

Morgans Equity Strategy Sept 2011 On Sept 7 JPMorgan came out a report titled Global Markets Outlook and Strategy. 3M Implied Volatility - model versus actual values Actual y-axis. APPROACH Invests primarily in large cap stocks but may invest in companies across all market capitalizations.

Transcript Asia Pacific Equity Research Analyst Directory October 2014 Asia Pacific Equity Research Analyst Directory Asia Pacific Equity Research 31 October 2014 Management Sunil Garg Director of Asia-Pacific Equity. JP Morgan offers the same multi-factor strategies in the US branded as Diversified Return funds listed on the NYSE Arca exchange. Morgans Equity Strategy Sept 2011 On Sept 7 JPMorgan came out a report titled Global Markets Outlook and Strategy.

Assets means net assets plus the amount of borrowings for investment purposes. Global assets under management AUM Source. Morgan Equity Income Strategy Separately Managed Account Designed to provide a blend of long-term growth and current income through the consistent payment of dividends.

Large Cap Equity Strategy Separately Managed Account Designed to provide high total return primarily through US. Morgan scrapped this strategys three-pronged management structure in favor of a more traditional system and for good reason. Ready for the recovery.

Shareholders Equity is a main portion of the balance sheet of a company that measures the net value of a company. Previously managers Scott Davis Susan Bao and. Here we would like to share the equity strategy written which we think is the most sought after reference for investors to strategize during this uncertain times.

Need Help with JP Morgan Marketing Strategy. Below is the excerpt from the said report. JP Morgan now offers four actively managed enhanced equity index ETFs in Europe providing exposure to global US European and emerging market stocks.

Order download for 12. Shareholders Equity Definition. Our broad range of actively managed equity strategies covering multiple investment styles and geographies is designed to help investors build stronger equity portfolios.

Morgan Asset Management data as of 30 September 2020. Key facts and comparisons for JPMorgan Equity Long-Short UCITS ETF - GBP Hedged acc JLSP IE00BDDRF254 justETF The ETF Screener. Companies in the SP 500 Index which.

FACT SHEET September 30 2020 JP. With collaboration among 370 equity investment professionals and an average of 13 years of experience across seven locations JP. Here we would like to share the equity strategy written which we think is the most sought after reference for investors to strategize during this uncertain times.

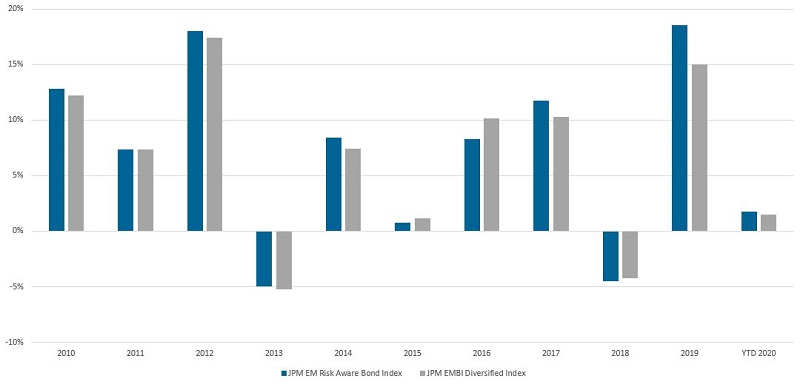

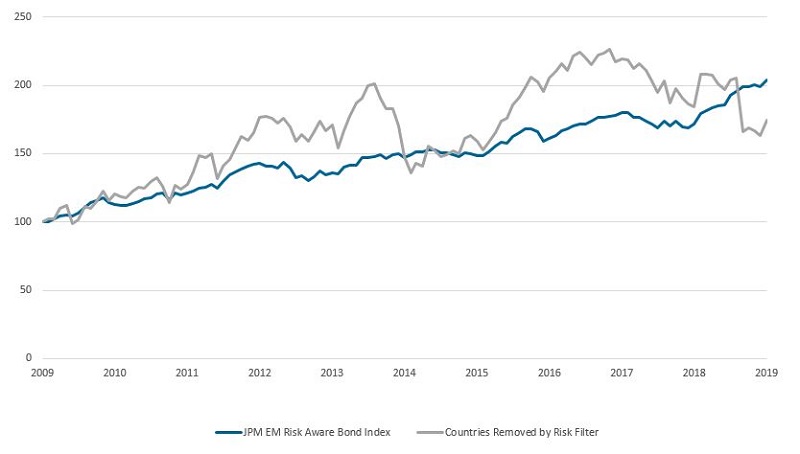

A More Thoughtful Approach To Emerging Market Debt J P Morgan Asset Management

A More Thoughtful Approach To Emerging Market Debt J P Morgan Asset Management

Investment And Commodities Investing Asset Management Capital Market

The Defining Events Of The Decade

How Esg Affects The Investment Process J P Morgan Asset Management

Has Indexing Gotten Too Big Asset Management Advisor Index

Jonathan Lourie Is The Founder Chief Executive Officer And Chief Investment Officer Of Cheyne Capital Management Uk Llp Under His Leadership Cheyne Capital

Are Sinking Bond Yields Signaling A Shift In Investors Expectations

Jpmorgan Equity Income Fund A J P Morgan Asset Management

Risk Limits Are Made To Be Broken Financial Times

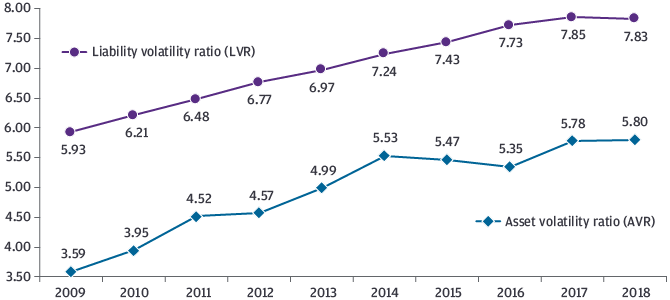

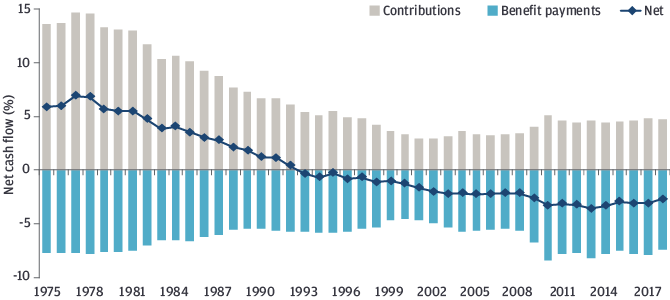

Maturing Public Pension Plans Strategies To Overcome Market Volatility And Portfolio Illiquidity J P Morgan Asset Management

Relentless Financial Improvement J P Morgan Chase Palladium Card Review Cards Palladium Chase

Emerging Markets Debt Time To Buy J P Morgan Asset Management

Value Investing Growth Less Msci World Value Rolling 3 Yrsreturns Dec 1974 May 2017 Value Investing Investing This Or That Questions

Maturing Public Pension Plans Strategies To Overcome Market Volatility And Portfolio Illiquidity J P Morgan Asset Management

Corporate Pension Peer Analysis 2021 J P Morgan Asset Management

Selling A Business Give Buyers What They Need To Up The Price J P Morgan Private Bank

The Rule Of Lourie Interview With Jonathan Lourie Jonathan Jamie Dimon Interview