You can get Income Tax back or pay less tax if youre self-employed pay your own work expenses make pension contributions or donate to charity Claim Income Tax reliefs -. Both the father and the mother may share the PTR to offset their income tax payable.

Lhdn Irb Personal Income Tax Relief 2020

Each unmarried child of 18 years and above who is receiving full-time education A-Level certificate matriculation or preparatory courses.

Personal income tax child relief. You should continue to claim the personal reliefs if you have met the qualifying conditions. Marital and civil status. Children and tax relief.

There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. Restricted to 1500 for only one mother. Employment expenses and tax relief.

Tax Reliefs And Rebate For Parents. Method of calculating relief to be allowed for double taxation. PART IV Ascertainment of total income 36.

Select Edit My Tax Form. In line with the effort to increase Malaysian workforce in achieving self-sustainable economy with strong domestic consumption Government has laid. 500000 MMK for a child If the child is above 18 years old and if the child is student allowance for this child will be considered 3.

Do also take note. Total income from all sources. PART V Rate of tax and double taxation 37.

Claiming tax relief for a child 3. Parents are eligible to claim the Parenthood Tax Rebate PTR of 5000 for their 1st child 10000 for the 2nd child and 20000 for the 3rd and each subsequent child. PART VI Persons chargeable and returns 40.

Personal tax reliefs are legally approved deductible allowances intended to reduce individuals chargeable income and thereby lessen the tax burden. See how you can claim for a tax deduction if you have dependant children. If your child is 16 year or over at the start of the year they must have been in full time instruction at any school or in full time higher education for example a degree course or equivalent.

Find out what expenses you can and can. Claiming a tax refund if you are unemployed. Personal relief and relief for children dependants.

Deductions Reliefs and Parenthood Tax Rebate. Charge of income tax. It is intended to mitigate the effect of tax on the individual and to make it bearable for them to pay the tax.

For example a working mother with two children may claim 45 of income earned as tax relief under this IRAS scheme. A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment. Child Relief When we are having children its a gift from God.

Go to Individuals File Income Tax Return. In line with the effort to increase Malaysian workforce in achieving self-sustainable economy with strong domestic consumption Government has laid. Click Update and enter your claim.

And Malaysia is a blessed place to live a place where no earthquake and volcano. For the second child 20 of earned income is eligible for tax relief. If your child is in full time higher education they must be a dependent student as defined by student finance.

Restricted to 1500 for only one father. Deductions to be claimed. For the third and subsequent children 25 of earned income is eligible for tax relief.

High Income Earner Restriction HIER Stay and Spend Scheme. Child Relief When we are having children its a gift from God. The maximum income tax relief amount for the lifestyle category is RM2500.

Find out the circumstances in which we grant tax relief for childcare and how much you can claim. If the employee will earn not more than 4800000 MMK per year heshe is not eligible for Personal Income Tax. 23 Zeilen Each unmarried child and under the age of 18 years old.

Although we once hit by tsunami but it brings minimal effect to us. MarriageResponsibility Relief Disability Relief Aged Relief Child Education Relief can be claimed upfront provided the income is. Details about the apportionment of income tax exemption thresholds personal allowances and reliefs Child care tax relief.

The percentage of tax rebate can also be added up to a maximum of 100. Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner Parent. Although we once hit by tsunami but it brings minimal effect to us.

How to Claim e-Filing Login with your SingPass or IRAS Unique Account IUA at myTax Portal. Individual and dependent relatives. Under the PENJANA recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from RM2000 to RM3000However this is not applicable when you file this year as it only applies to the Year of.

Each unmarried child of. If you have a golf club membership that also has gym facilities it would not qualify for this income tax relief. Tax rates bands and reliefs.

However please evaluate whether you would benefit from the tax relief and make an informed decision. And Malaysia is a blessed place to live a place where no earthquake and volcano. If the total amount of reliefs claimed exceeds the relief cap the tax reliefs will be capped at.

So if you bought a computer that costs more than that you can no longer include your gym membership internet subscription and others for income tax relief. Each unmarried child of 18 years and above that. 26 Zeilen Amount RM 1.

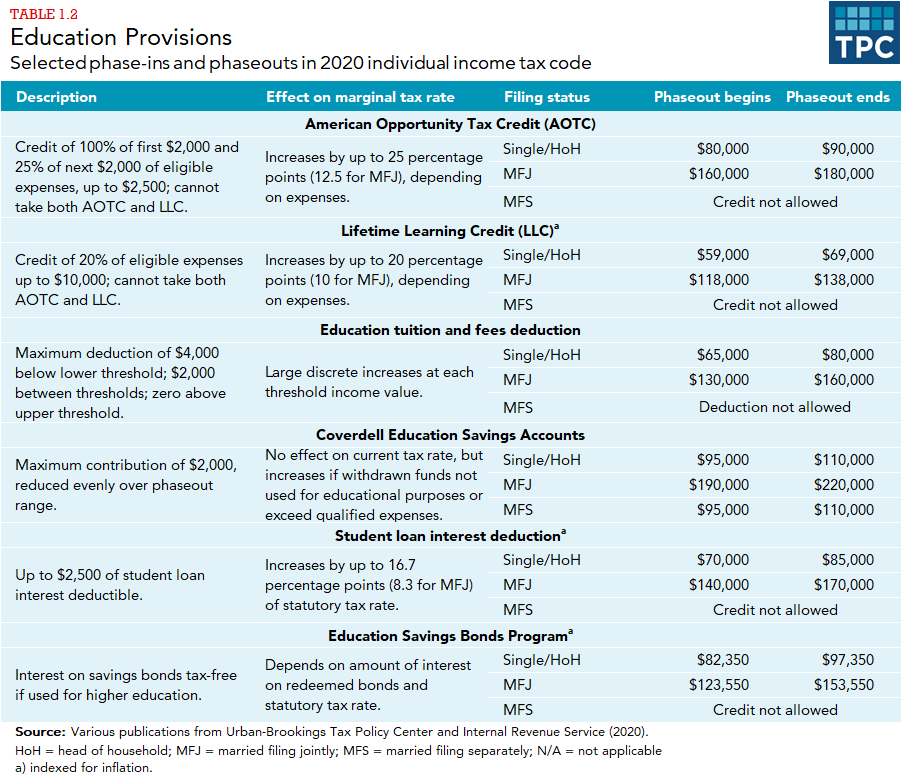

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Child Tax Credit Calculator How Much Will I Get

Income Tax 2020 Everything You Should Claim As Income Tax Relief News Rojak Daily

What Is The Child Tax Credit Ctc Tax Foundation

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

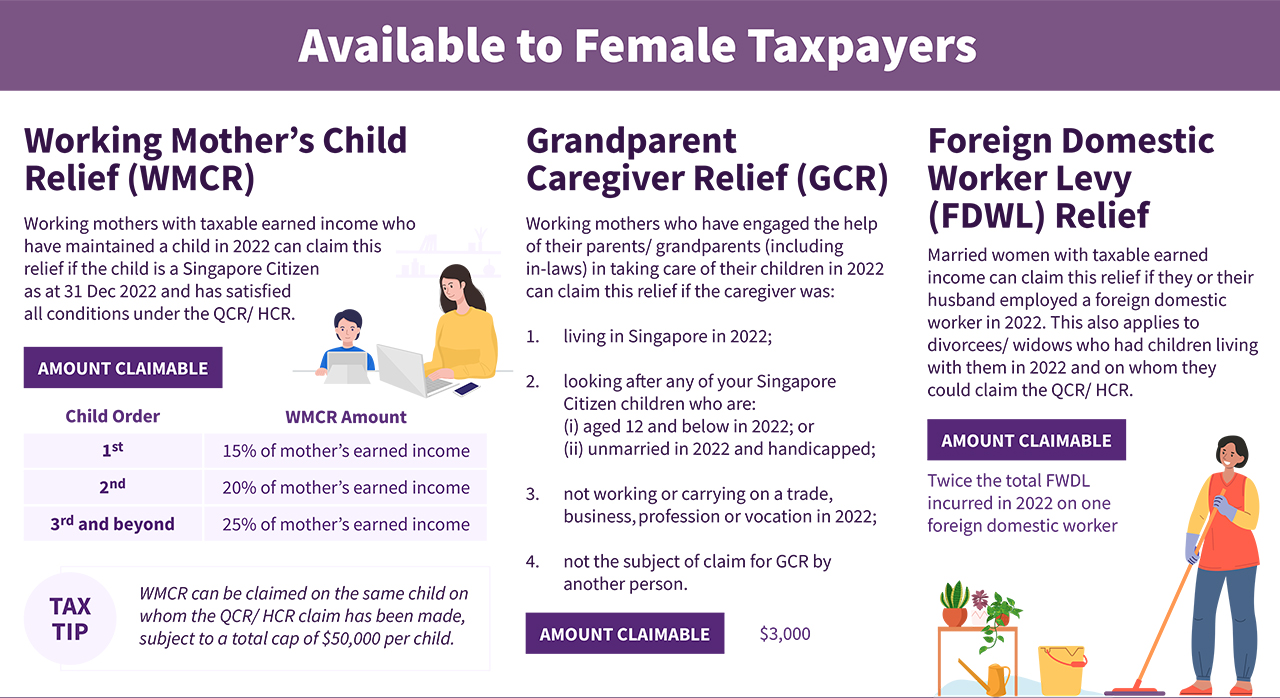

Reduce Your Tax Payments In 2021 With These Tips Dbs Singapore

How To Reduce Your Income Tax In Singapore Make Use Of These Tax Reliefs And Deductions

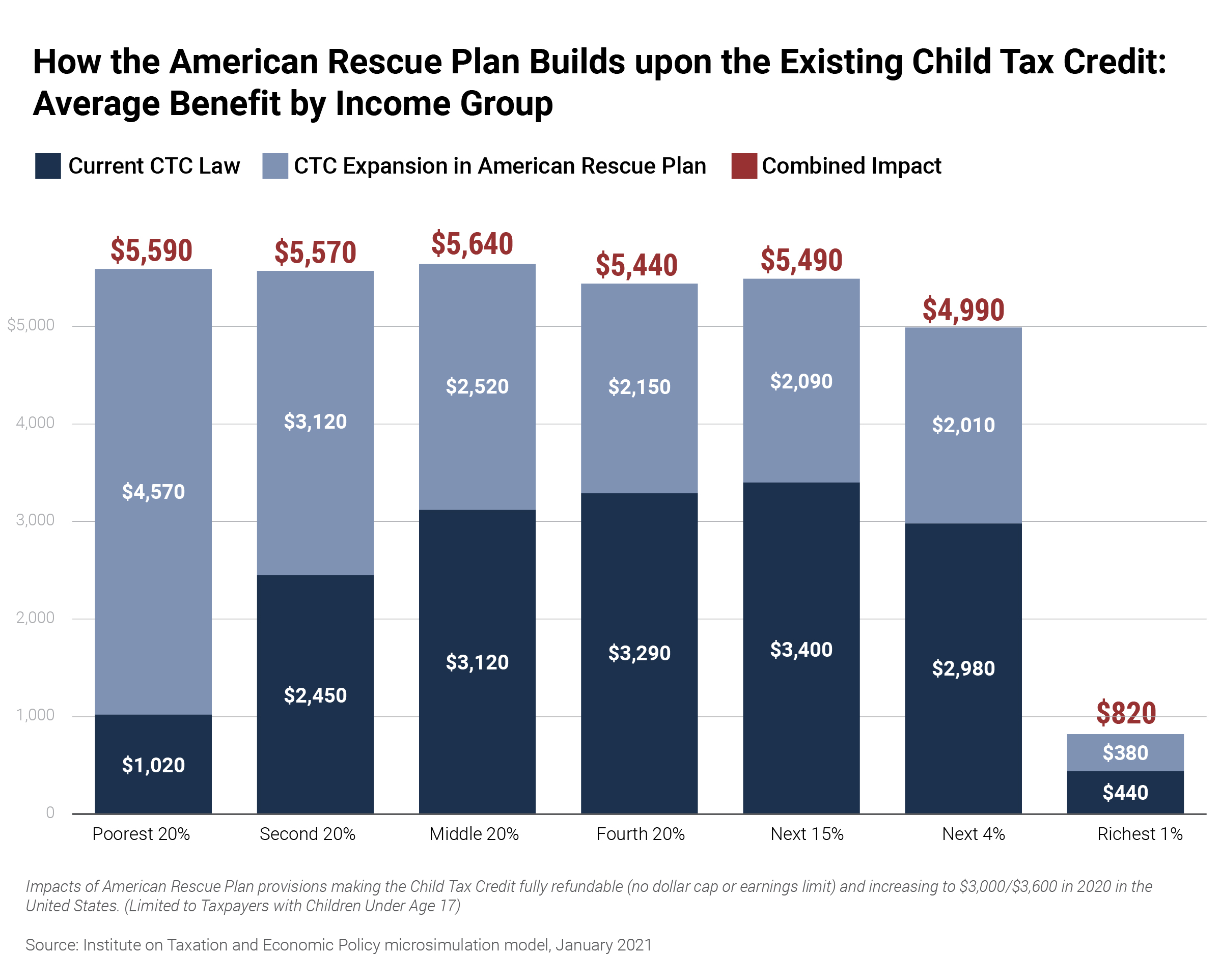

Covid Relief Bill Update How Much Are Child Earned Income Tax Credits And Who Is Eligible

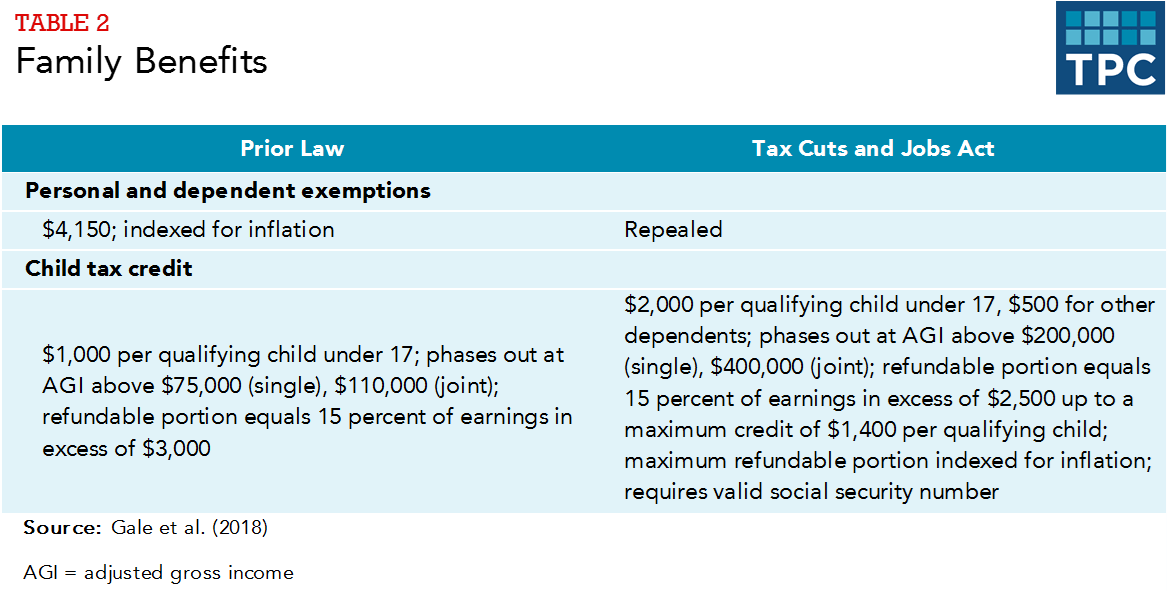

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Child Tax Credit Enhancements Under The American Rescue Plan Itep

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How To Reduce Your Income Tax In Singapore Make Use Of These Tax Reliefs And Deductions

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018 Money Malay Mail Tax Refund Income Tax Tax

How To Reduce Your Income Tax In Singapore Make Use Of These Tax Reliefs And Deductions

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)