Shockwaves have been sent around the property investing community. In addition several Government consultation documents are awaited that could lead to further future changes.

Financial Stability Review May 2018

The Government had already imposed the 15pc stamp duty on all properties bought through a corporate envelope above 2m but from midnight last night it will fell to just 500000.

Budget 2014 property sector hit hard by. Property Sector Hit Hard by RPGT and DIBS ruling As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed. Landlords are going to take a big hit but not immediately. The Australian public expect to see greater fiscal responsibility and efficiency within the State and Federal Public Sector concerning the delivery of essential public services according to Grant Thornton Operational Advisory specialist Rory Gregg.

Out of the 3 tightening rules forecast by Finance Malaysia 2 already Bingo. Budget 2014 contained a number of announcements that will impact the property sector. Extension of the Annual Tax on Enveloped Dwellings ATED capital gains tax and 15 SDLT rate to residential properties over 500000.

However there was more bad news for non-residents and those holding UK property in enveloped structures. Out of the 3 tightening rules forecast by Finance Malaysia 2 already Bingo. Property Sector Hit Hard by RPGT and DIBS ruling As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed.

UK businesses and commercial property landlords in particular are set to lose 11bn from the cut in capital allowances announced in last months budget according to Savills. The Government has announced the extension of existing. Given this need Budget 2013 has unfortunately delivered a body blow to learners.

The freehold apartment located near Johor Bahrus city centre was twice the size of his 3-room HDB flat in Singapore but the cost was only half of the latter when he bought. The Telegraph reports that Landlords could. Property Sector Hit Hard by RPGT and DIBS ruling October 27 2013 Get link.

Post Leaving Certificate courses are increasingly important for obtaining employment in these uncertain times. We think the approach is too hard even though we do not agree to sky rocketing propertys prices. By Julie Hanson - Just Do Property Host 9 Jul 2015 Property News.

Many are expecting a slew of changes to curb property speculation such as the. Leary Partners quantity surveyor and tax law expert Kaylene Arkcoll forecasts a bleaker future for investors in Australias residential property -- particularly strata unitsThe budget has stripped investors buying second-hand residential prop. PROPERTY consultants and analysts described the proposed new real property gains tax RPGT regime and the removal of the developers interest bearing scheme DIBS as both timely and much needed in view of the speculation in the property market of late.

As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed. Landlords are still reeling from the effect the emergency budget will have on their property rental profits. In addition several Government consultation documents are awaited that could lead to further future changes.

Property Sector Hit Hard by RPGT and DIBS ruling As widely expected property sector would be one of the hardest hit sector in view of the proposed cooling measures to be imposed. We feel that it is because cost is increasing and developers have transferred the cost to consumer. In addition several Government consultation documents are awaited that could lead to further future changes.

They are vital for school leavers and adult learners who need to up skill or add value to their existing portfolio of skills that may allow them to enter the workforce. Chartered accountancy firm MacIntyre Hudson has said that the Chancellors budget decision to phase out industrial buildings allowances will hit the hotel sector hard. Also as it is a highly related fact to quantitative easing.

Budget 2014 will hit hard to local property industry. Taxes are increasing in Victoria but Premier Daniel Andrews says its so his re-elected government can do more than promised and not fill a 52 billion revenue void. Treasurer Tim Pallas will deliver his fifth budget on Monday after delaying it by a month blaming the federal election.

On Saturday he unveiled several new and increased charges along with. Summer Emergency Budget hits landlords hard. When Singapore business owner Jonathan Gan purchased a 4-room condominium at Lovell Country Garden in 2018 he thought he had clinched his dream retirement home.

Out of the 3 tightening rules forecast by Finance Malaysia 2 already Bingo. Property owners hit hard in budget. The Budget saw the Chancellor announce some welcome measures for the real estate sector including reliefs and stimuli designed to encourage investment and construction activity by SMEs in particular.

Affordable housing remains a thorny issue but the chorus of calls for more transparent information on property prices and values grows louder. Out of the 3 tightening rules forecast by Finance Malaysia 2 already Bingo. Budget 2014 contained a number of announcements that will impact the property sector.

Read our previous articles regarding property. Extension of the Annual Tax on Enveloped Dwellings ATED capital gains tax and 15 SDLT rate to residential properties over 500000. Extension of the Annual Tax on Enveloped Dwellings ATED capital gains tax and 15 SDLT rate to residential properties over 500000.

The root is whether it is speculative or other reasons that caused the price hike. All eyes are on next Fridays Budget 2014 announcement which many predict will have a big impact on the property industry. All of them agree that the overall budget for the property sector.

Budget 2014 contained a number of announcements that will impact the property sector. PLC Sector Hit Hard by Budget 2013. October 27 2013 26 Oct 2013.

A Bunch Of Reasons To Consider Having Luxembourg Real Estate In Your Investment Portfolio

Australia Property Market Housing Market Predictions 2021 Rent Prices Sydney Melbourne Brisbane Hobart Managecasa

Rental Housing Market 2021 Will Rent Prices Rise Or Fall In 2022 Managecasa

The Unassuming Economist Housing Market In Finland

Rental Housing Market 2021 Will Rent Prices Rise Or Fall In 2022 Managecasa

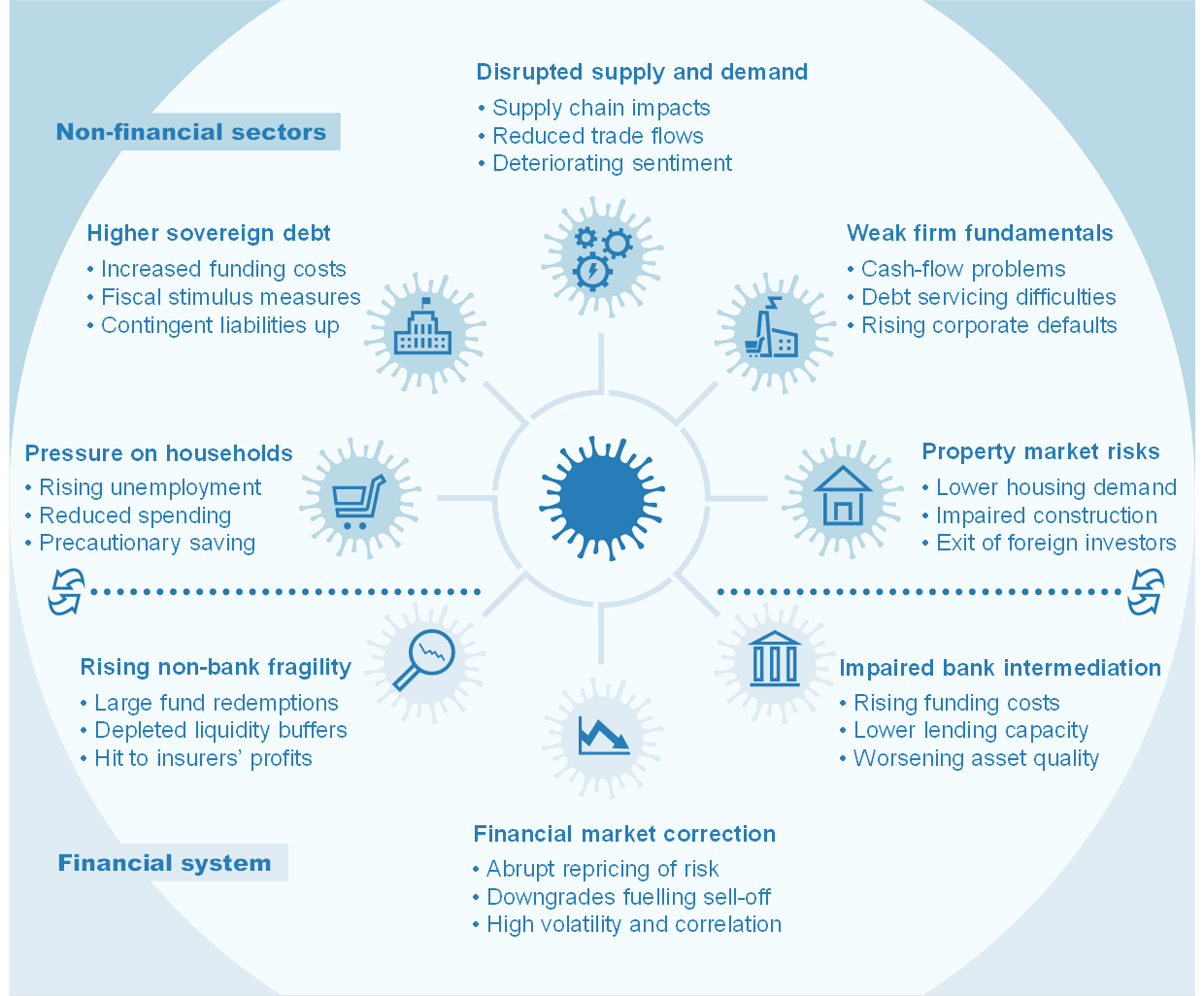

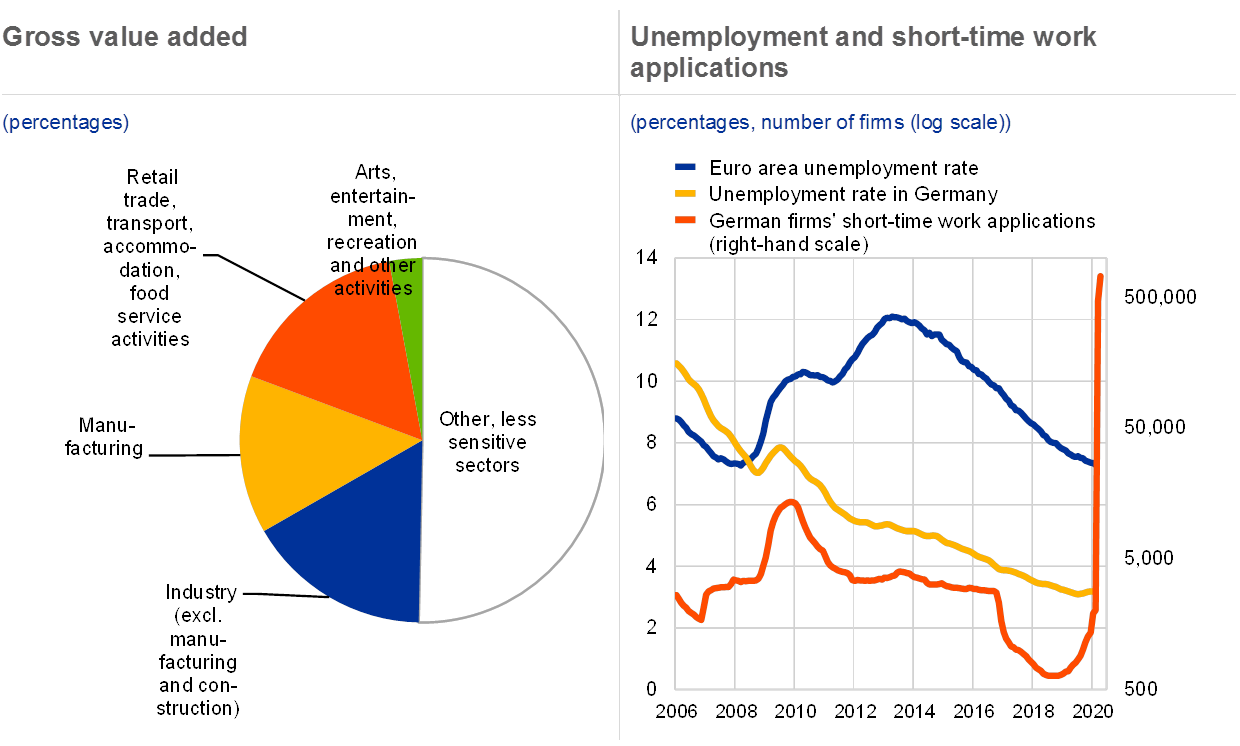

Financial Stability Review May 2020

A Bunch Of Reasons To Consider Having Luxembourg Real Estate In Your Investment Portfolio

How Covid 19 Could Drive Esg Adoption In The Real Estate Industry

Financial Stability Review May 2018

A Bunch Of Reasons To Consider Having Luxembourg Real Estate In Your Investment Portfolio

Everyone Can Learn From Sydney S 30 Year Property Market History Propertyology

Financial Stability Review May 2020

Berlin Rent Freeze Shakes Foundations Of City S Construction Sector Financial Times

China S Indebted Residential Property Development Sector Seafarer Funds

The Financialization Of Rental Housing Evictions And Rent Regulation Sciencedirect

China S Indebted Residential Property Development Sector Seafarer Funds

Key Policy Insights Oecd Economic Surveys Israel 2020 Oecd Ilibrary

A Bunch Of Reasons To Consider Having Luxembourg Real Estate In Your Investment Portfolio

Australia Property Market Housing Market Predictions 2021 Rent Prices Sydney Melbourne Brisbane Hobart Managecasa