Latest Updates on Coronavirus Tax Relief American Rescue Plan Act of 2021 See this IRS news release for more information on individual tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. Find information on the most recent tax relief provisions for taxpayers affected by disaster situations.

5 April 2012 Dear Sir Mdm Simplified Income Tax Filing For Small

For prior tax relief provided by the IRS in disaster situations based on FEMAs declarations of individual assistance please visit Around the Nation.

Ya2013 special tax relief. We found that homeowners need more help and less hype to get the tax relief. Business Pakistan Pakistan Top Stories. Govt announces special tax relief measures introduces steps to enhance tax to GDP ratio.

Property tax reduction will be through a. But the question still remains how much relief will be given. To assess your tax situation and determine if you qualify for tax relief contact us for a free consultation.

Special relief is a form of overpayment relief that can only apply to amounts charged in HMRC determinations for income tax. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. Simply put this is by far the kindest and gentlest IRS that Ive seen in my lifetime.

Armed Forces Receive Special Tax Benefits when Filing Taxes. The special session began July 8 and lasts for 30 days after which the session can be extended for another 30-day period. SACM12220 - Overpayment relief.

The upcoming national budget is slated to be tabled in November 2020. With Texans wanting their tax bills lowered Gov. See FAQs for Disaster Victims for information about the definition of an affected taxpayer.

July 8 2021 Members of the military could qualify for special tax benefits. You are leaving ftbcagov. The Franchise Tax Board today announced updated special tax relief for all California taxpayers due to the COVID-19 pandemic.

So if you bought a computer that costs more than that you can no longer include your gym. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. The above is in addition to the existing lifestyle relief of MYR 2500 whereby the cost of purchasing a handphone notebook or tablet is claimable by resident individuals as part of the lifestyle relief.

The special tax relief is claimable for YA2020 only. The Ministry of Youth and Sports KBS has proposed the introduction of a special tax relief incentive for the purchase of sports equipment and parents investment for their children in sports under Budget 2021. Computer annually payment of a monthly bill for internet subscription.

Optima Tax Relief provides assistance to individuals struggling with unmanageable IRS tax burdens. The maximum income tax relief amount for the lifestyle category is RM2500. One way they could deliver this relief is by using federal taxpayer monies but long-term sustained relief requires a complete rethinking.

Example If you spent 60 and pay tax at a rate of 20 in that year the tax relief you can claim is 12. According to minister Datuk Seri Reezal Merican. Sports equipment and gym membership fees.

22 Compliance Implications This special relief for group members allows members to reduce their tax liabilities by using other group members losses. Adding property tax relief is a big win for taxpayers Texans for Fiscal Responsibility said in a statement. Howeverand this is a BIG howeverthings are going to change soon.

Shaukat Tarin says he plans to restructure tax. We do not control the destination site and cannot accept any responsibility for its contents links or offers. Property taxes have grown by 181 in the last two decades in.

Books journals magazines printed newspapers. Greg Abbott put property tax relief on the Texas Legislatures to-do list in the first special session of this year. Youll get tax relief based on what youve spent and the rate at which you pay tax.

Texans Looking for Property Tax Relief in Special Session. 21 Group Relief for Losses Group members of a company registered in Sierra Leone with a minimum of 25 holding in the group can claim members losses for up to ten 10 years. Tax relief is administered and communicated so that homeowners and other taxpayers can evaluate the performance of their government and the promises it made to them.

Texans are increasingly growing fed up with consistently rising property taxes and want the legislature to address the issue in the coming special session according to a new poll. Austin City Council looks to provide property tax relief Real estate brokerage Redfin said the average Austin metro area homeowner paid 277 more in. The legislation also made changes to tax relief for employersContinue to check back for updates.

Special Tax Relief Opportunities During Covid-19 Crisis. For example they do not have to pay certain types of taxes and special rules may even lower the taxes they owe or allow them additional time to file and pay their federal taxes. The IRS and most state taxing authorities have radically altered the way they collect unpaid taxes during the COVID-19 pandemic.

Review the sites security and confidentiality statements before using the site.

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Businesses Foreign 20tax 20credit Worked 20example Pdf

Https Www Sbf Org Sg Images Pdf Pbc Tax 20filing 20for 20companies 20for 20year 20of 20assessment 202014 20 Pdf

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Common Mistakes On Claims For S14q Deduction Tax Deduction Expense

Tax Cheat Sheet Tax Deduction Taxes

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Quick Links Explanatory 20notes 20to 20form 20c S 20ya 202013 Pdf

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Schemes Pic 20illustration 20 20training Pdf

Capital Allowances Write Off Interest

Singapore Productivity And Innovation Credit Scheme Guide

Tax Incentives Mines Wellness City

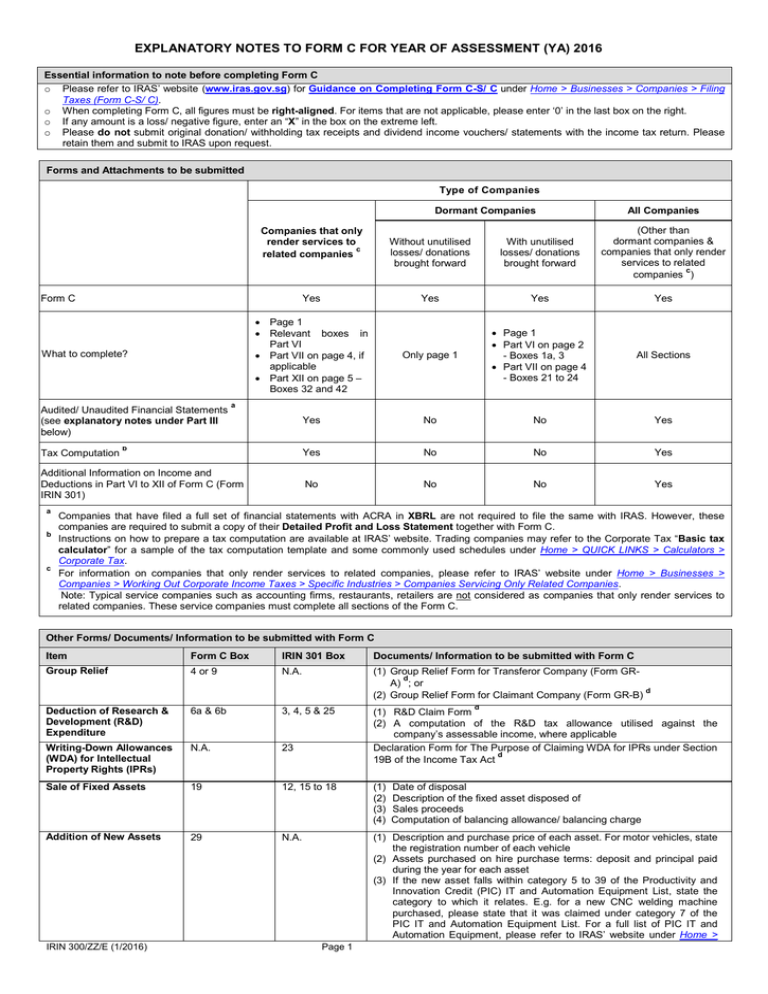

Explanatory Notes To Form C For Year Of Assessment Ya 2016

Do You Know That You Get A 30 Corporate Tax Rebate For 3 Years From Ya 2013 To Ya 2015 Learn More Here H Singapore Business Corporate Tax Rate Tax Rebates

Annex B 2 Research And Development R D Tax Measures Pdf Free Download

Year Of Assessment 2013 Guide On Filing Of Form B Iras

Tax Assessment Assignment Tax Assessment Taxation

Irb Guidelines For Income Tax Treatment Of Mfrs 5 Pages 1 7 Flip Pdf Download Fliphtml5

Singapore Does Not Need To Emulate Nordic Type Welfare

Productivity And Innovation Credit Scheme In Singapore This Infographic Will Help You Understand How Your Company Can Enjoy U Innovation Singapore Infographic