If your adjusted gross income was 58000 or less in 2010 you can use free tax software to prepare and e-file your tax return. Select your state s and download complete print and sign your 2010 State Tax Return income forms.

Tax Revenue Statistics Statistics Explained

117 rows 2010 personal income tax forms Select to view another year - Year - 2019 2018 2017 2016.

Personal income tax 2010. Page 1 of 8 PERSONAL INCOME TAX BULLETIN 2010-02 Issued. Joining the 95 million Americans who already are. Download Fill-In Form 127K 200-01X Resident Amended Income Tax Return.

Ordinary taxable income brackets for use in tax planning and filing 2010 tax returns due April 18 2011 the later date is due to a federal holiday in Washington DC. Individual Income Tax Forms and Instructions for Single and Joint Filers with No Dependents and All Other Filers. Jerry Brown D has proposed a ballot initiative to re-enact the higher rates.

File by April 15. July 22 2010 Guidance for Investors in Fraudulent Investment Schemes The purpose of this bulletin is to provide guidance to investors in fraudulent investment. The proposed amendments implement the changes required by Chapter 57 of the Laws of 2010 over a twelve-month period rather than the shorter implementation period required.

Proposal of amendments to Appendix 10-C of Title 20 NYCRR to provide New York City income tax withholding tables and methods applicable to wages and other compensation paid on or after January 1 2011. Personal Income Tax Forms 2010 Tax Filing Season Tax Year 2011 Form Title Filing Date. DEX 93 -- Personal Income Tax Correspondence Sheet.

D-40 and D-40EZ D-40 Fill-in D-40EZ Fill-in Also included in this booklet are the following payment vouchers and schedules. DFO-02 -- Personal Individual Tax Preparation Guide for Personal Income Tax Returns PA-40. You can no longer claim a refund for Tax Year 2010.

2010 Pennsylvania TeleFile Worksheet 1-888-4PAFILE 1-888-472-3453 Number of Forms W-2 If more than 7 youcannot use TeleFile. Options for e-filing your tax returnssafely quickly and easily. Use Free File Fillable Forms.

Individual Income Tax 2010 Leave unused boxes blank. Do not use staples on anything you submit. The calculator reflects known rates as of Janunary 06 2010 and please also note that the personal income tax calculator doesnt reflect the CPP and EI deductions or contributions for your 2010 personal income tax rates.

Then download print and mail the 2010 IRS Tax Forms to the address listed on the IRS and State Forms. State Elections Campaign Fund If you want 5 to go to help candidates for state offices pay campaign expenses you may each enter the code number for the party of your choice. Download Fill-In Form 53K 200 V Payment Voucher.

Name Address and SSN. The 2010 total tax liability for all filers was 50 billion up 74 percent from 47 billion in 2009. P R I N T C L E A R L Y.

The top rate will drop from 1055 on income over 1 million to 103. How to Read These Tax Rate Charts First find your filing status then find your income level. Greater AccuracyFewer errors mean faster processing.

The average tax liability for all filers was 2790 in 2010 up 60 percent from 2663 in 2009. PA-19 -- PA Schedule 19 - Sale of a Principal Residence. Individual Income Tax Decreases California s across-the-board addition of 025 to each tax bracket will expire on schedule on December 31 2010 after existing for two years.

Round by eliminating any amount less than 050 and increasing any amount that is 050 or more to the next highest dollar. This will not increase your tax or reduce your refund. Individual Income Tax Return 2010.

For example a single person earning 50000 would be in the 25 tax bracket in 2010. Delaware Non-Resident Individual Income Tax Return Instructions for Form 200-02 Download Fill-In Form 181K 2010 Income Tax Table. Personal income tax up-to-date information for 2010 Articles 22 and 30 Select to view another tax year - Year - 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001.

2010 Personal Income Tax Forms All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 401 574-8970 Items listed below can be sorted by clicking on the appropriate column heading. 2010 Personal Income Tax Forms. PIT as a percentage of total tax revenue decreased from 313 in 200405 to 284 in.

1545-0074 99 IRS Use OnlyDo not write or staple in this space. Calculate your 2010 personal income tax combined federal and provincial tax bill in each province and territory of Canada. PA-1 -- Online Use Tax Return.

Download Fill-In Form 90K Schedule W Apportionment Worksheet. Information from each Form W-2 Wage and Tax Statement Enter amounts in whole dollars. Personal income tax PIT company income tax CIT and value-added tax VAT remained the largest sources of tax revenue collectively comprising around 80 of total tax revenue.

Department of the TreasuryInternal Revenue Service OMB No. The number of taxpayers choosing to file their return electronically in 2010 grew 139 percent to 134 million. She would pay federal income tax of 468125 plus 25 on her income over 34000.

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

The History Of Taxes Here S How High Today S Rates Really Are

Tax Revenue Statistics Statistics Explained

Tax Revenue Statistics Statistics Explained

Tax Revenue Statistics Statistics Explained

Tax Revenue Statistics Statistics Explained

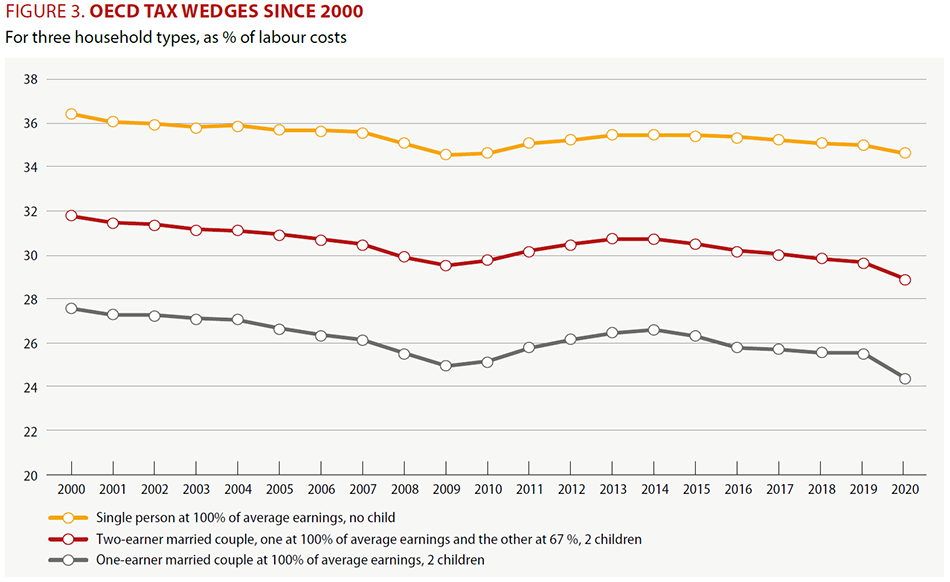

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Personal Income Tax An Overview Sciencedirect Topics

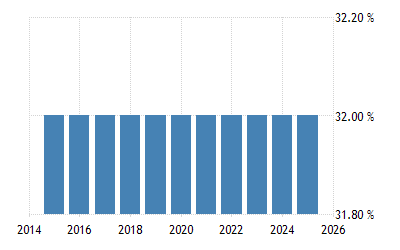

Poland Personal Income Tax Rate 1995 2021 Data 2022 2023 Forecast Historical

How To Calculate Income Tax In Excel

Reforming The Individual Income Tax In Spain Springerlink

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

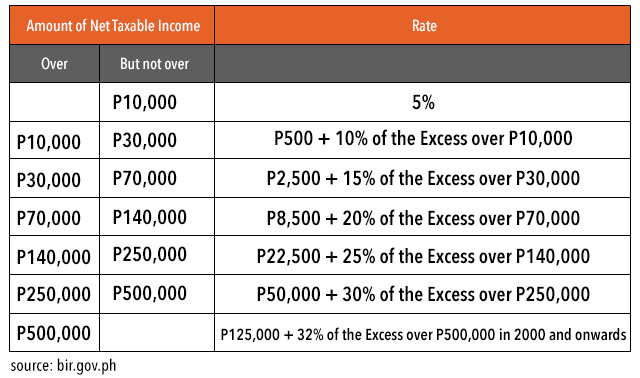

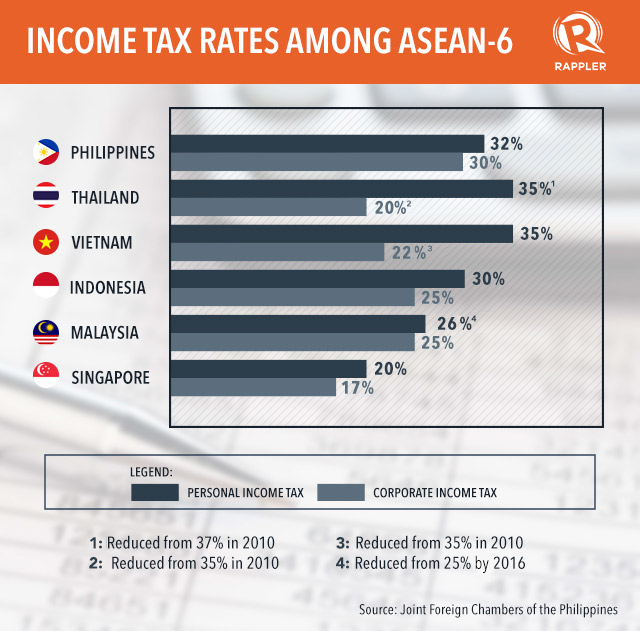

Why Ph Has 2nd Highest Income Tax In Asean

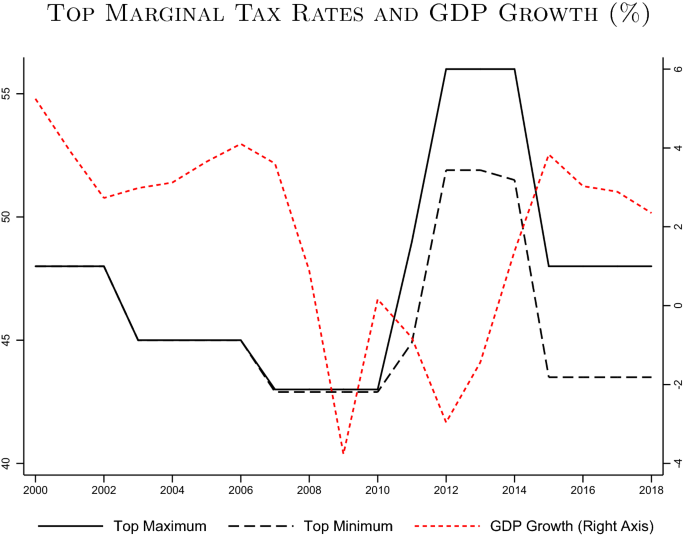

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018