The withdrawal amount should be at least the following. You were able to withdraw the 100 EPF corpus amount after the retirement at the age of.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of.

Lesser amount can be withdrawn for epf. Generally the increasing amount was at least 50 once youre age 27 onward. According to the law an organization has to pay gratuity to an employee who has served it continuously for at least 5 years. Higher limit means lesser money you can withdraw from EPF in the future.

Lesser Amount can be Withdrawn for EPF Members Investment Scheme effective January 2014 Are you an EPF member who withdraw money out for investment scheme. How much will be increased. Increase of Retirement Age limit.

A 90 of the EPF balance can be withdrawn after the age of 54 years. When a employee can apply for his final EPF withdrawal he is eligible for claim both Employee and employer share. If an employee withdraws full EPF amount after resigning from the.

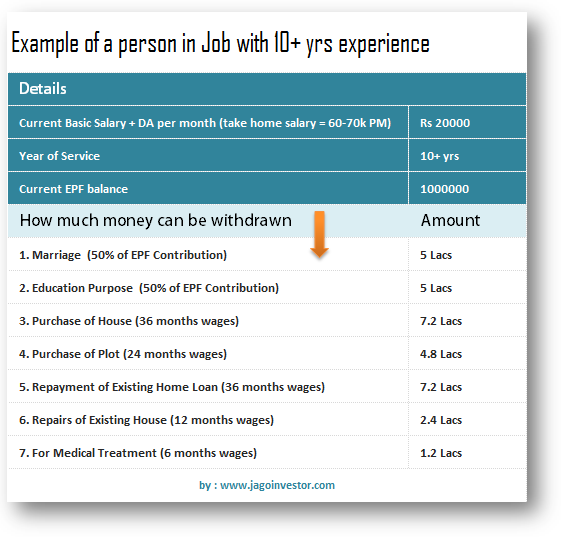

EPF amount cant be withdrawn before the 57 age at the job. Then this is a very important news to you. The maximum amount that can be withdrawn is 36 times the salary.

EPF withdrawal before 5 years of continuous service attracts TDS on the withdrawal amount. Continuity of your EPF membership Existing rule. B After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment.

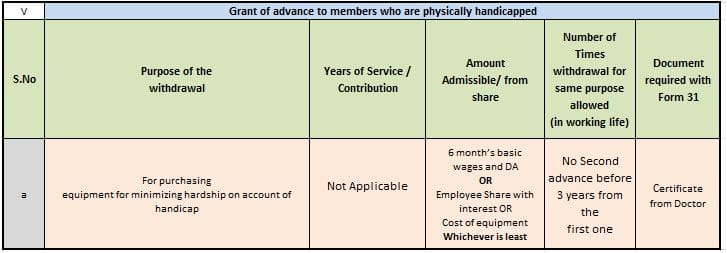

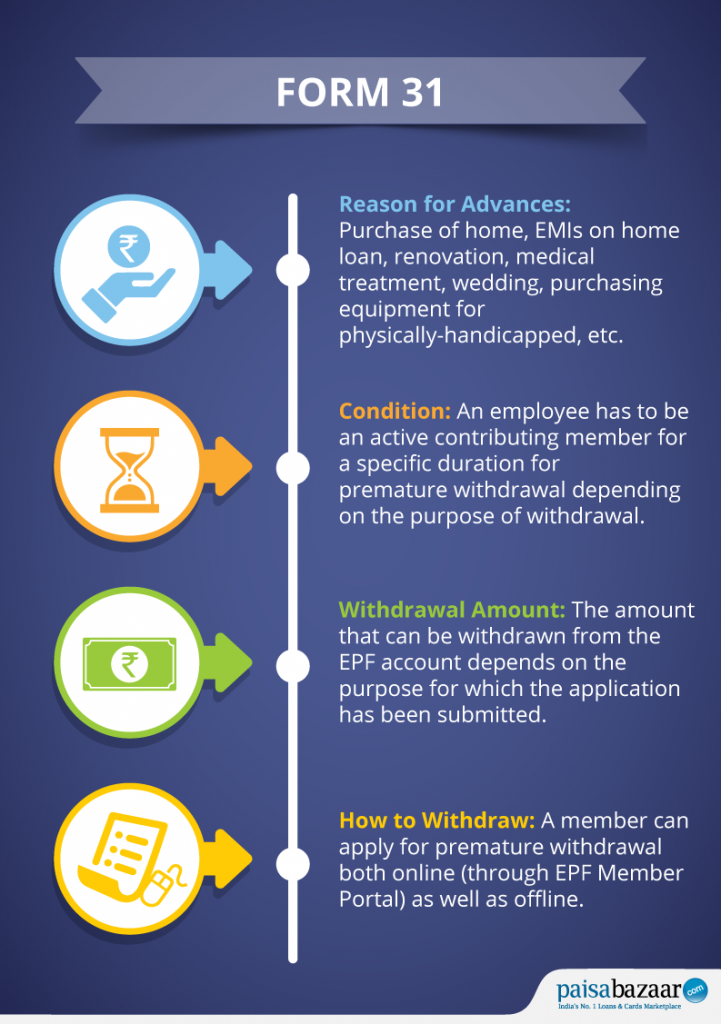

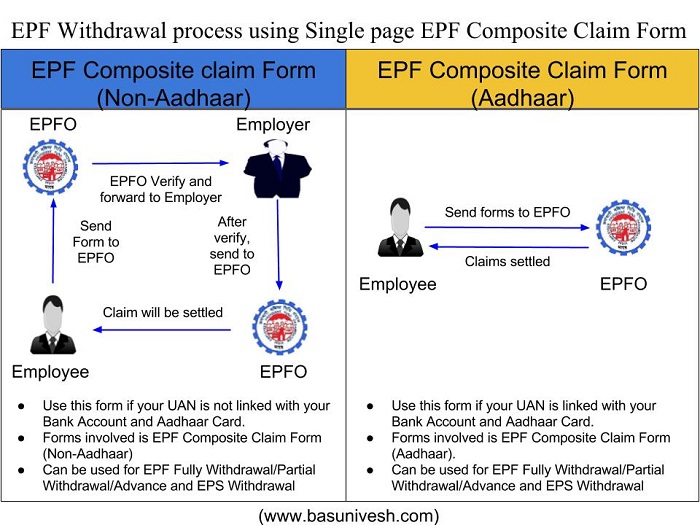

Till today the minimum retirement age limit for EPF withdrawal was 55 years. At the time of Resignation or Job Change. Also this form serves as an application for partial withdrawal of funds from the EPF account.

Are you an EPF member who withdraw money out for investment scheme. Here are the main amendments to EPF withdrawal rules-. Since the withdrawal is considered as income of the investor the funds withdrawn from the EPF account before 5 years of continuous service are fully taxable as per the investors applicable tax slab TDS will be deducted if the amount withdrawn is more than Rs50000.

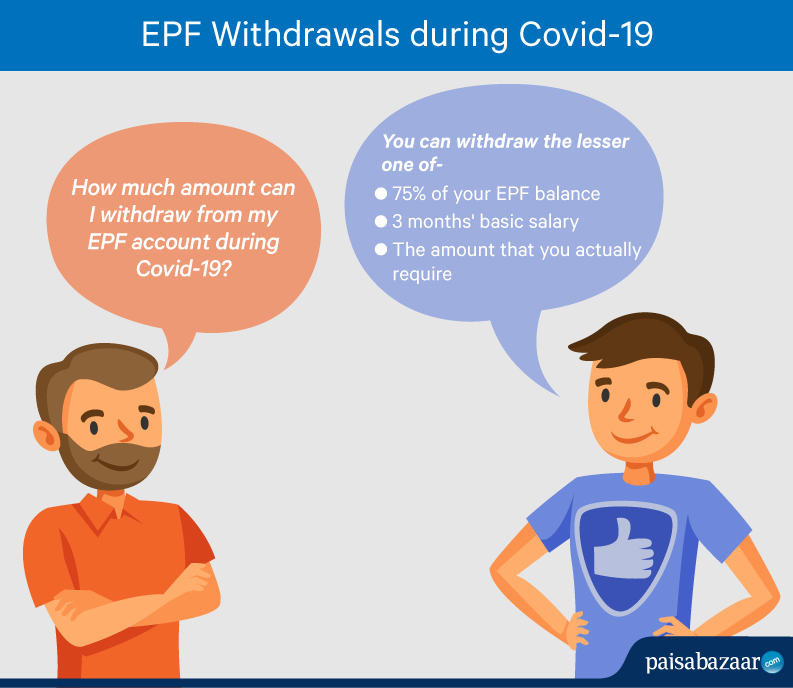

Effective January 2014 the minimum basic savings required in Account 1 was revised upward. The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser amount of the two. You can withdraw your contributions interest portion only.

The withdrawn amount is non-refundable which means that there is no need to restore the amount in the EPF. This will affect all of YOU who withdrawn certain amount from EPF account 1 for eligible investment purpose. Lesser Amount can be Withdrawn for EPF Members Investment Scheme effective January 2014.

Effective January 2014 the minimum basic savings required in Account 1 was revised upward. Higher limit means lesser money you can withdraw from EPF in the future. The employers portion can be withdrawn after attaining the retirement age 58 years.

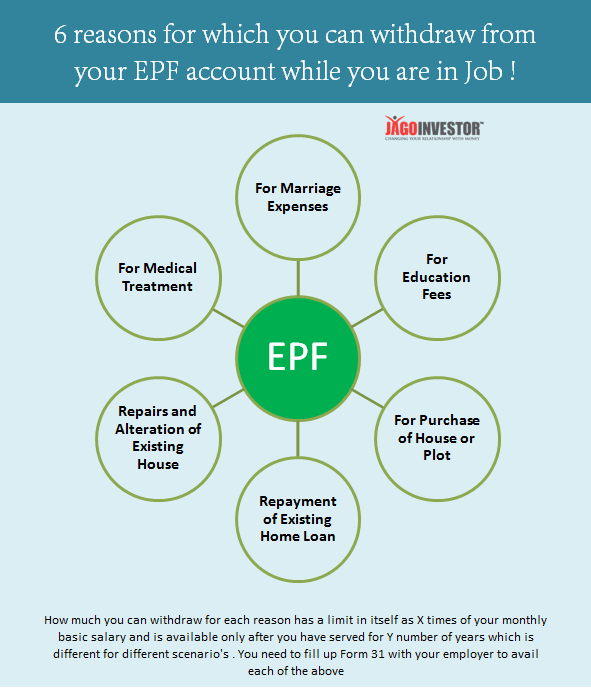

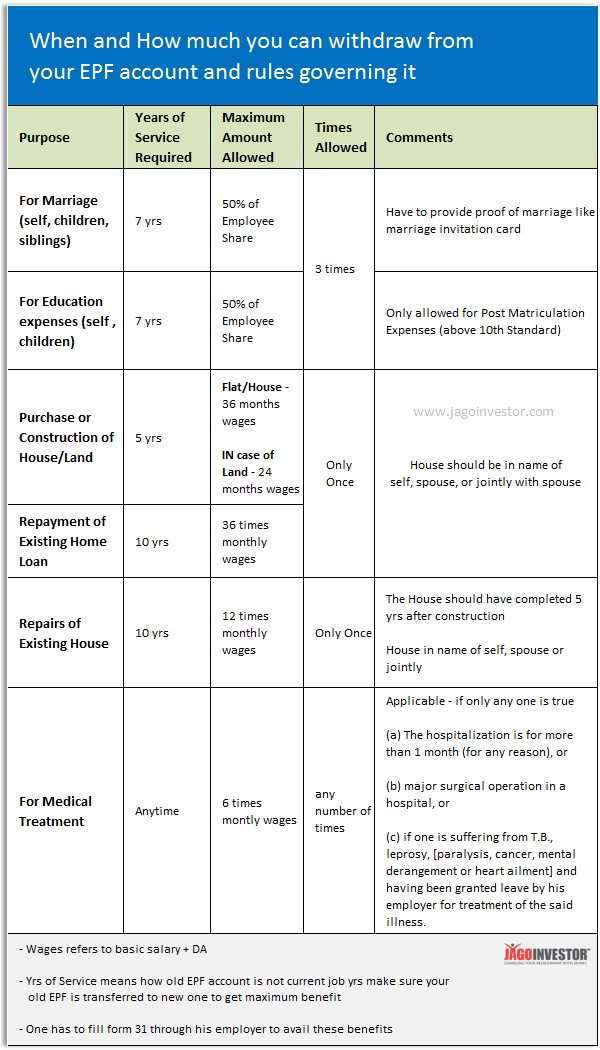

90 of the EPF balance can be withdrawn after the age of 54 years. You can withdraw fron your EPF for your marriage if you have held your EPF account for 7 years. Furthermore there is a certain criterion for the withdrawal from the EPF account.

EPF withdrawal rules say that it is illegal to withdraw epf while making job switch. Then this is a very important news to you. Repairs or alterations to an existing home The home should be in the name of the EPF member spouse or.

The money from this account cannot be withdrawn as and when required. You can withdraw up to 50 of your share with interest. EPF membership is not finished with leaving the job.

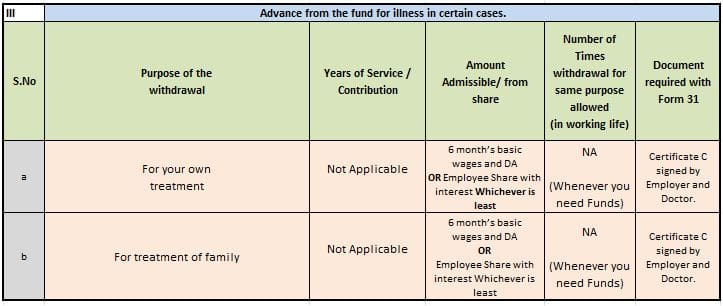

Form 31 of Employees Provident Fund is also known as the PF Advance Form. You can withdraw epf only when you have no job and 2 months have been passed since your last employment in other words you should be unemployed for at least 2. For each year of service the organization has to pay an amount equaling 15 days of last drawn.

100 EPF corpus amount withdrawal is not allowed before the retirement. 24 months basic salary and DA. Effective January 2014 the minimum basic.

The maximum amount that can be withdrawn to purchase a site or plot is 24 times the salary. The EPF is a scheme put in place by the Government in 1991 to help you save part of your money for your golden years. Based on the chart below the percentage increased can be as high as 64.

An employee can withdraw the EPF amount for a house or flat purchase and construction of house including the acquisition of the site. Hang on the EPF Employees Provident Fund in Malaysia will make sure that the final amount you bring home will be a little lesser than expected but for a good cause. For EPF Withdrawal For Purchasing A Site plot or flat the limit of money that can be withdrawn is 90 of your total amount in your PF account and the share must be more than 1000 rupees as a contribution to your fund.

For purchase of site.

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Partial Withdrawals Advances Options Guidelines 2020 21

What Is The Use Of Form 31 In Pf Quora

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Form 31 Instructions Filing Procedure How To Download

Epf Withdrawals New Rules Provisions Related To Tds

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Withdrawal Or Advance For Medical Expenses Basunivesh

Epf Form 15g How To Fill Online For Epf Withdrawal Basunivesh

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Covid 19 Know How Much You Can Withdraw From Your Epf

Epf Partial Withdrawal Or Advance Process Form How Much

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process