Heres What You Should Do. You can hold precious metals in a direct form with coins or bullion bars but you can also invest indirectly through ETFs that hold actual gold.

Land The Best Asset For Your Inflation Hedge Portfolio Seeking Alpha

You can also invest in gold mining stocks or in funds comprised of these stocks.

How to invest during high inflation era. The amount of money being pumped into the system has reached unprecedented levels as JPOW FED Chair has let the money printer go literal BRRR for the past 1 year since the March. Equity investing is an effective inflation hedge because the stock market tends to outpace inflation. Nearly 20 of all US Dollars that EXIST right now were printed in 2020.

19 Best Ways to Protect your Money from Inflation and Economic Collapse. Prices for commodities like corn soybeans or petroleum tend to rise quickly with higher inflation. He warned before the financial crisis.

But people who invested in REAL assets did quite well. Feel free to invest in homes and related property. If rental prices and property values go up with inflation the stock prices of REITs are likely to rise and your investment is likely to grow.

If you wish to invest in the SP 500 an index of the 500 largest US. Investing in Stocks. And when adjusted for inflation stock market investors LOST about 49 during the 1970s.

Anything above 322 can be considered high inflation. However these are stocks and not the actual metal itself. Both technology and communication services are capital-light businesses so theoretically they should be inflation winners.

It was a brutal time to be an investor in mainstream assets. Some people who do not like taking risks may not like this but the truth still remains that during periods of rapid inflation the value that money has can greatly reduce within a short period of time. The best areas to invest in during periods of inflation include technology and consumer goods.

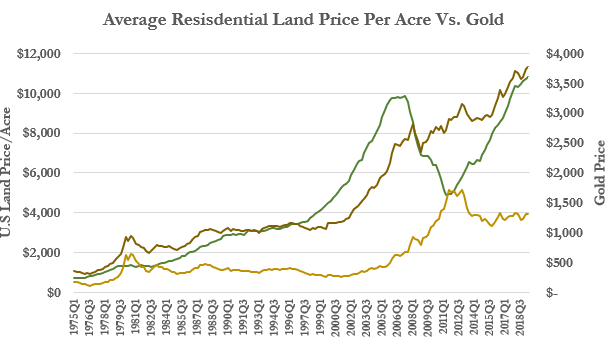

Consider farmland for example. High Inflation is Coming. According to the US Department of Agriculture the average price of US farmland in 1970 was 137 per acre.

If there is one sure-fire way to beat inflation over long periods of time its investing in stocks. Real estate investing is a hard asset thats easy to invest in. Commodities can be another smart investment during inflationary periods.

Although rising interest rates will lead to higher mortgage prices that doesnt necessarily cause home prices to drop. Land and property like commodities tend to rise in value during periods of inflation. Let that sink in.

The average inflation rate from 1913 to 2013 was 322. Many companies are able to pass of rising prices to the end customer so. Continue to invest in the stock market.

4The best investments during inflation include treasure protected securities step up notes and CD ladders. The solution is investing for inflation choosing investments that will give you a return greater than the current rate of inflation or at least keep up with it. Inflation stocks might prosper during inflationary periods.

Take a look at commodity funds. Aside having the potential to provide good profit even in periods on inflation such sectors also have the added advantage of being relatively cheap to invest in. Precious metals such as gold and silver have traditionally been viewed as good hedges against inflation.

In the late 1970s and early 1980s he devoted significant portions of the Berkshire Hathaway annual letter to investing in stocks during inflationary periods. Keep investing in the stock market regardless of the economic scenario. The following are recent years that had above-average inflation.

Get Rid of Your Cash. To understand how certain investment classes performed during inflationary periods those periods need to be defined along with what is considered above-average inflation.

How To Prepare For Inflation 8 Actionable Tips

Charted The World S Largest Ipos Adjusted For Inflation Initial Public Offering Financial Wealth Global Stock Market

We Are In An Interesting Time For Equity Investing Because Productivity Is Stuck In A Rut Yet Stocks Are Levitati Investing Stuck In A Rut Productivity Growth

Protect Your Portfolio From Inflation Kiplinger

Active Vs Passive Investing In Fixed Income Mark Mitchell Livewire Investing Income Investing Income

Top 3 Best Assets For An Inflation Hedge Warrior Trading

How To Invest Smartly When Inflation Picks Up

How To Go From Md To Real Estate Magnate Cash Flow Wealthy Doc Real Student Encouragement Wealth Building

How To Invest Smartly When Inflation Picks Up

Gold And Silver A New Era Could Be Upon Us Gold Gold Futures Gold Bullion

How To Prepare For Inflation 8 Actionable Tips

How To Prepare For Inflation 8 Actionable Tips