Fixed Assets Journal Entries. This release includes the following items.

S 4 Hana New Asset Accounting Considering Key Aspects Sap Blogs

Whats new in Sage Fixed Assets 20211.

Fixed assets accounting releases new. New Asset Accounting is one of the areas that was further optimized to run on S4HANA with additional functionality and a new data structure along with full integration to Finance via the Universal Journal and the ACDOCA table. It is on roadmap for later releases that Fixed Asset Accounting calculates the depreciation with the historic activation values in all currencies but currently Fixed Asset Accounting does this only in the BSEG Currencies. Only the New Asset Accounting and the New General Ledger versions are available on S4HANA.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features 2020. Browse 966 NEW YORK FIXED ASSETS ACCOUNTANT job 60K-91K listings hiring now from companies with openings. Find your next job opportunity near you 1-Click Apply.

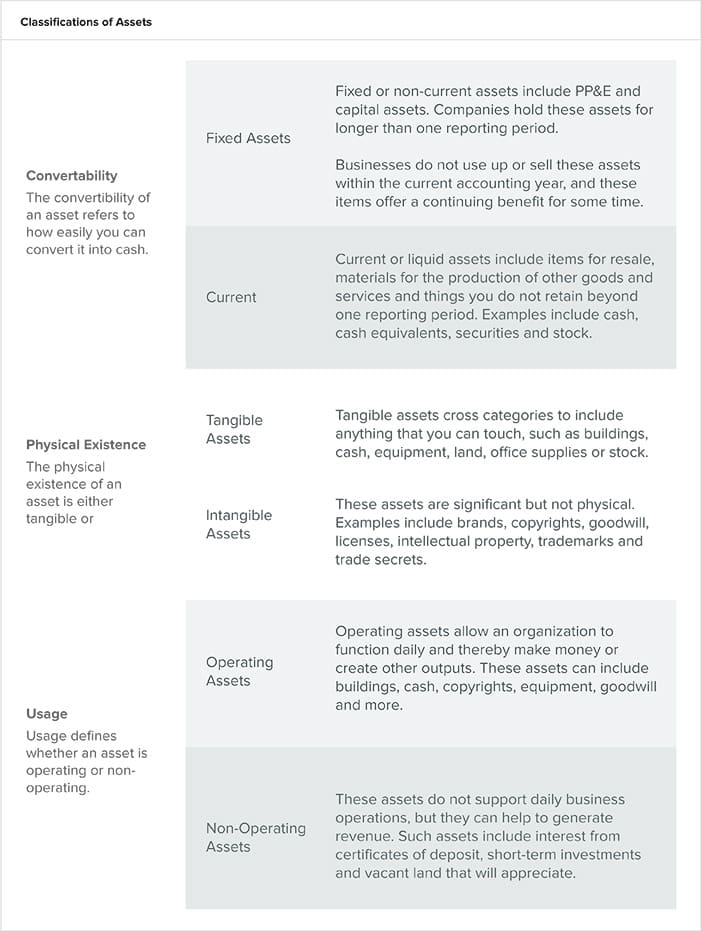

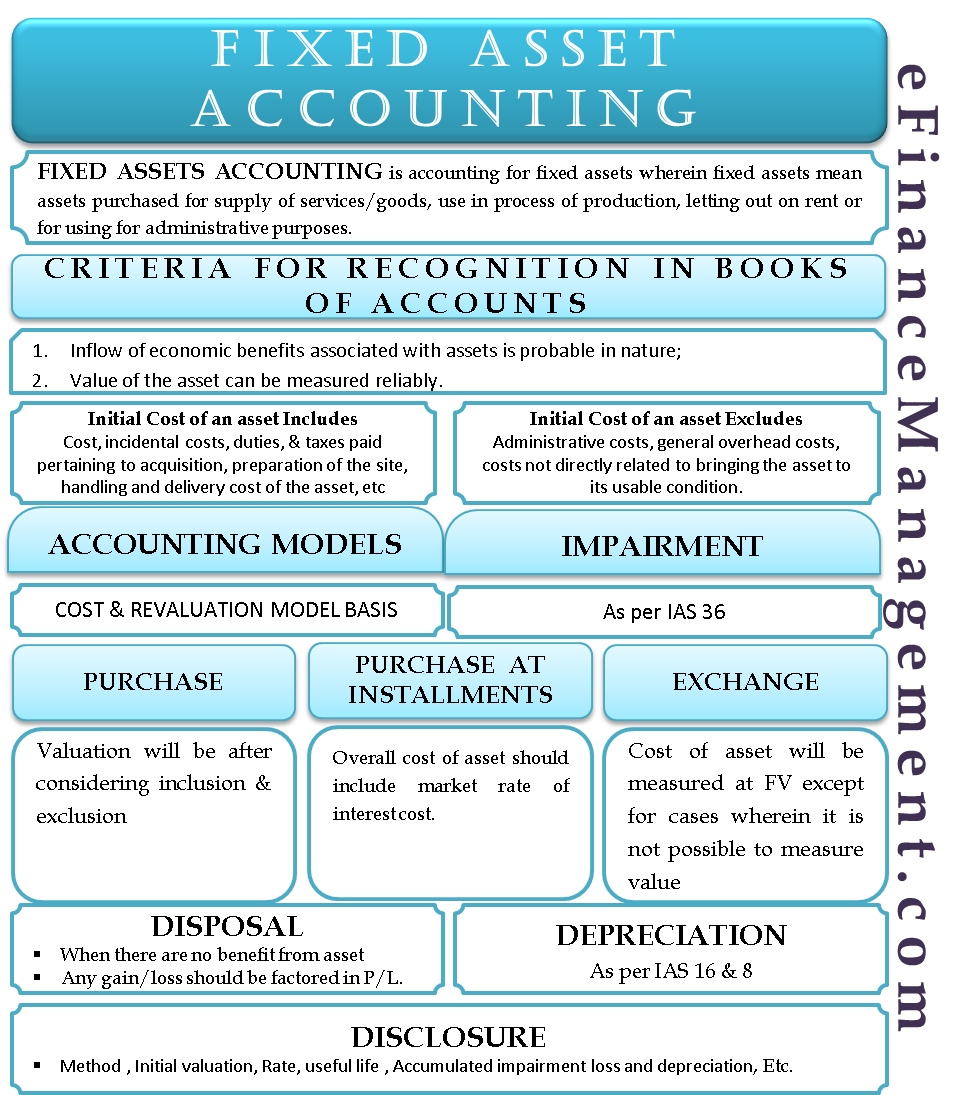

Fixed assets are tangible assets purchased for the supply of services or goods use in the process of production letting out on rent to third parties or for using for administrative purposes. Create and monitor a system of controls procedures and forms for the recordation of fixed assets. SAP launched its first version on ERP 60 Enhancement Pack 7 EHP7.

They are generally referred to as property plant and equipment PPE and are referred to. Examples of fixed assets include tools computer equipment and vehicles. An asset is fixed because it is an item that a business will not consume sell or convert to cash within an accounting calendar year.

A fixed asset is a tangible piece of property plant or equipment PP. In accounting fixed assets are physical items of value owned by a business. The new Lease Accounting feature will be included in the Fixed Assets Management SuiteApp in the v191 releasing in early 2019 in the March or April timeframe.

With the SAP New Asset Accounting many of the underlying principles and structures remain the same. They are bought for usage for more than one accounting year. In this blog post we will take a look at what is new in release 2020.

They last a year or more and are used to help a business operate. Since then it has since been optimized for SAP S4 HANA and S4 HANA Finance. The New Asset Accounting in SAP works on the HANA platform.

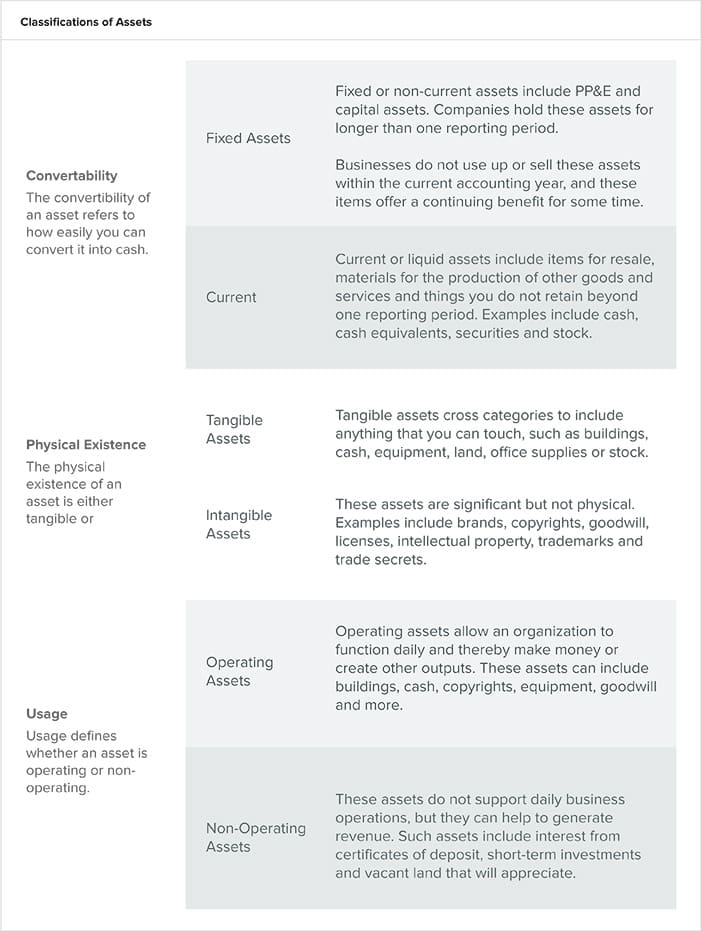

Fixed assets also known as Property Plant and Equipment are tangible assets held by an entity for the production or supply of goods and services for rentals to others or for administrative purposes. Bagaimana membuat New Fixed Asset di Accurate. Fixed asset accounting January 23 2021 How to Account for Fixed Assets A fixed asset is an item having a useful life that spans multiple reporting periods and whose cost exceeds a certain minimum limit called the capitalization limit.

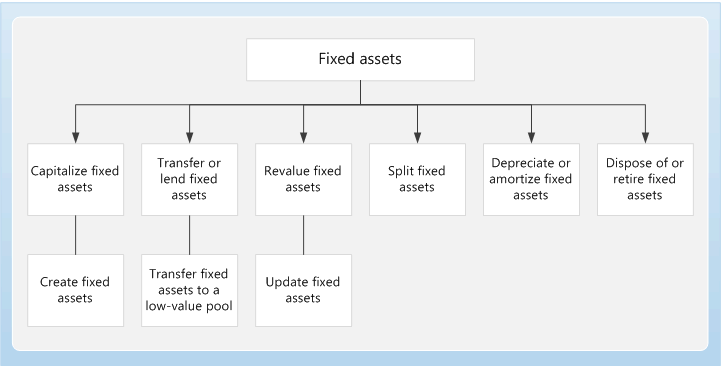

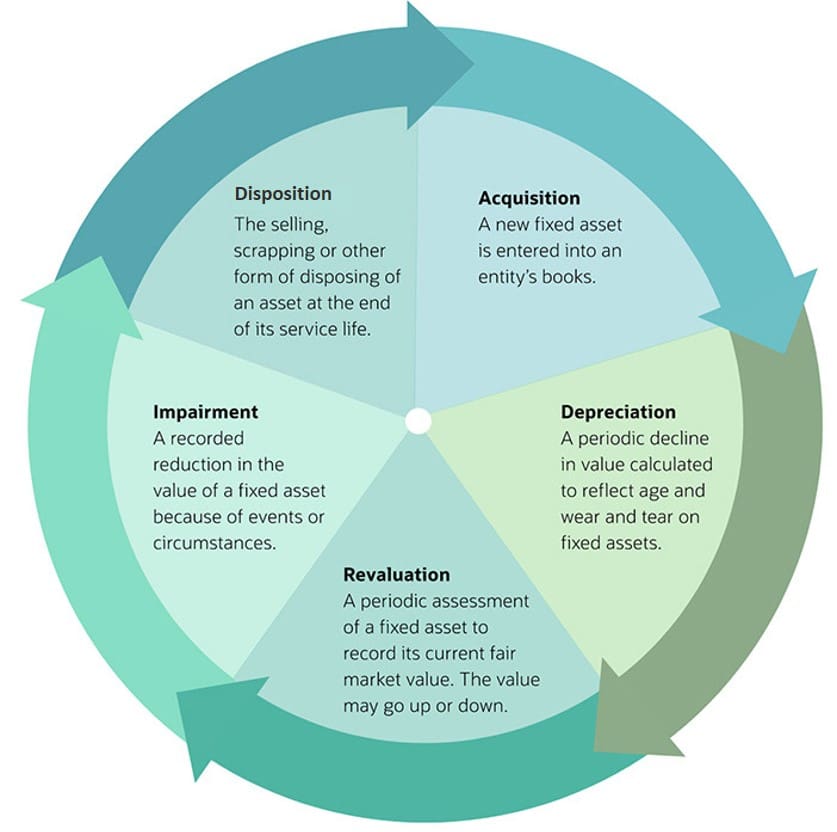

Fixed Assets normally refer to property plant and equipment that are held for use in the production or supply of goods or services for rental to others or for administrative purposes and they are expected to be used with more than one year accounting period. The fixed assets journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets. In the SAP system it is the Asset Accounting FI-AA component that is responsible for managing fixed asset processes such as acquisitions transfers retirements depreciation revaluations and reporting.

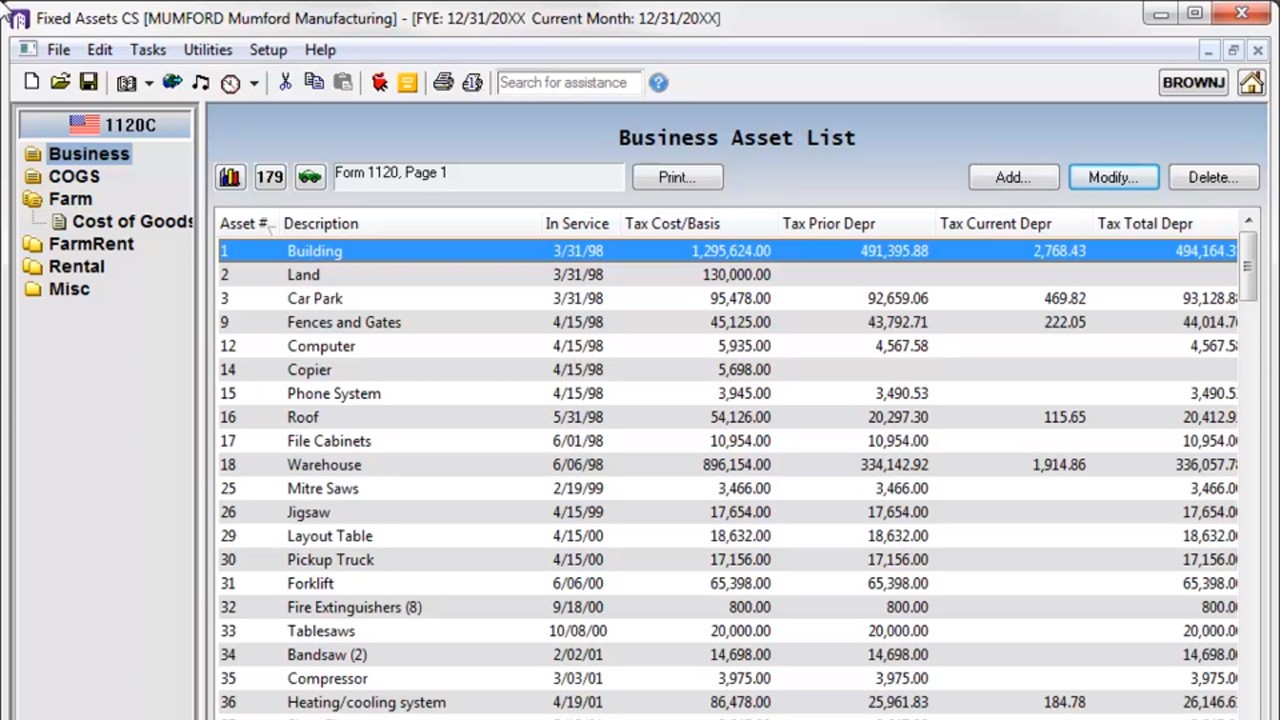

Tax updates including recently passed extenders Form 4562Depreciation and Amortization for 2020 Commas added to Form 4562 currency amounts Updated amortized property tax book defaults Simplified asset. The fixed asset accountant position is accountable for recording the cost of newly-acquired fixed assets both tangible and intangible tracking existing fixed assets recording depreciation and accounting for the disposition of fixed assets. Fixed assets help a company make money pay bills in times of financial trouble and get business loans according to The Balance.

These assets are expected to be used for more than one accounting period. The word fixed indicates that these assets will not be used up consumed or sold in the current accounting year. Fixed assetsalso known as tangible assets or property plant and equipment PPEis an accounting term for assets and property that cannot be easily converted into cash.

In each case the fixed assets journal entries show the debit and credit account together with a brief narrative. A fixed asset is also known as a non-current asset. If Fixed Asset Management is installed in your organizations NetSuite account there is important information to know about upcoming changes and exciting new features.

Learn more about our latest book release New Fixed Asset.

S 4 Hana New Asset Accounting Considering Key Aspects Sap Blogs

How To Record Sale Of Fixed Assets In Tallyprime Tallyhelp

Reclassify Fixed Assets Finance Dynamics 365 Microsoft Docs

Fixed Asset Depreciation Accounting Software Fixed Assets Cs

S 4 Hana New Asset Accounting Considering Key Aspects Sap Blogs

Fixed Asset Trade In Double Entry Bookkeeping

Confluence Mobile Community Wiki

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Fixed Asset Accounting Made Simple Netsuite

Fixed Assets Basics In Accounting Double Entry Bookkeeping

Confluence Mobile Community Wiki

Internal Controls And Audit Of Fixed Assets

Fixed Asset Register Template Double Entry Bookkeeping

Fixed Asset Accounting Made Simple Netsuite

S 4 Hana New Asset Accounting Considering Key Aspects Sap Blogs

Set Up Fixed Assets Finance Dynamics 365 Microsoft Docs