Shariah-compliant funds have many requirements that must be adhered to. KUALA LUMPUR 22 February 2020.

The Most Beautiful Coins Alte Munzen Pragung Munzen

The Employees Provident Fund EPF has announced dividends of 52 for conventional savings and 49 for shariah accounts for 2020.

Epf account conventional vs shariah. They have declared 64 Dividend for 2017 vs Conventional Savings 69. The Simpanan Shariah is a savings option managed and invested by the EPF in accordance with Shariah principles. Last years dividends of 545 conventional savings and 5 shariah savings were already EPFs lowest headline showing since 45 in 2008 when the amount needed to deliver 1 of dividend was RM318 billion.

The Employees Provident Fund EPF declared a dividend rate of 500 for Simpanan Shariah 2019 with a payout amounting to RM414 billion. Moving forward Amir Hamzah said he weighed a little bit heavier to investing in the Shariah segment. That is the balancing act that EPF has to do he added.

We are about 40 in Shariah and the balance is conventional. As for Conventional Savings their latest Dividend is the highest since 1996. Simpanan Shariah will be managed invested according to Shariah Principles.

Its a safe investment which guarantees an annual dividend of 25 but has often paid much higher returns. It is being closely watched by peers across the Islamic and conventional investment world partly for its investment and partly for the enormous impact it has had on the development of Islamic asset management across the whole country. Jul 20 2017EPF Simpanan Syariah EPF-iApproved after 71 positive respondents to Members Consultation on EPF Scheme Enhancement in April.

Based on the outcome of the Members Consultation on EPF Scheme Enhancement held in April 2015 a total of 71 of respondents members agreed for the introduction of a Shariah-compliant investment. Yes EPF is a very important part of your retirement planning. For those of you working in the gig economy running your own business.

And 640 per cent for Simpanan Shariah 2017 with payout amounting to RM398 billionIn total the payout for 2017 amounts to RM4813. Some of the requirements for a Shariah-compliant fund include the exclusion of investments which derive a majority of their. KUALA LUMPUR June 3 Contributors to the Employees Provident Fund EPF now have the option to switch from the existing savings scheme to one based on Islamic principles called Simpanan Syariah.

But that cannot be the perception that Shariah will give you a. These are slightly lower when compared with 2019. The EPFs investment assets are segregated into two portfolios namely the Shariah portfolio and conventional portfolio.

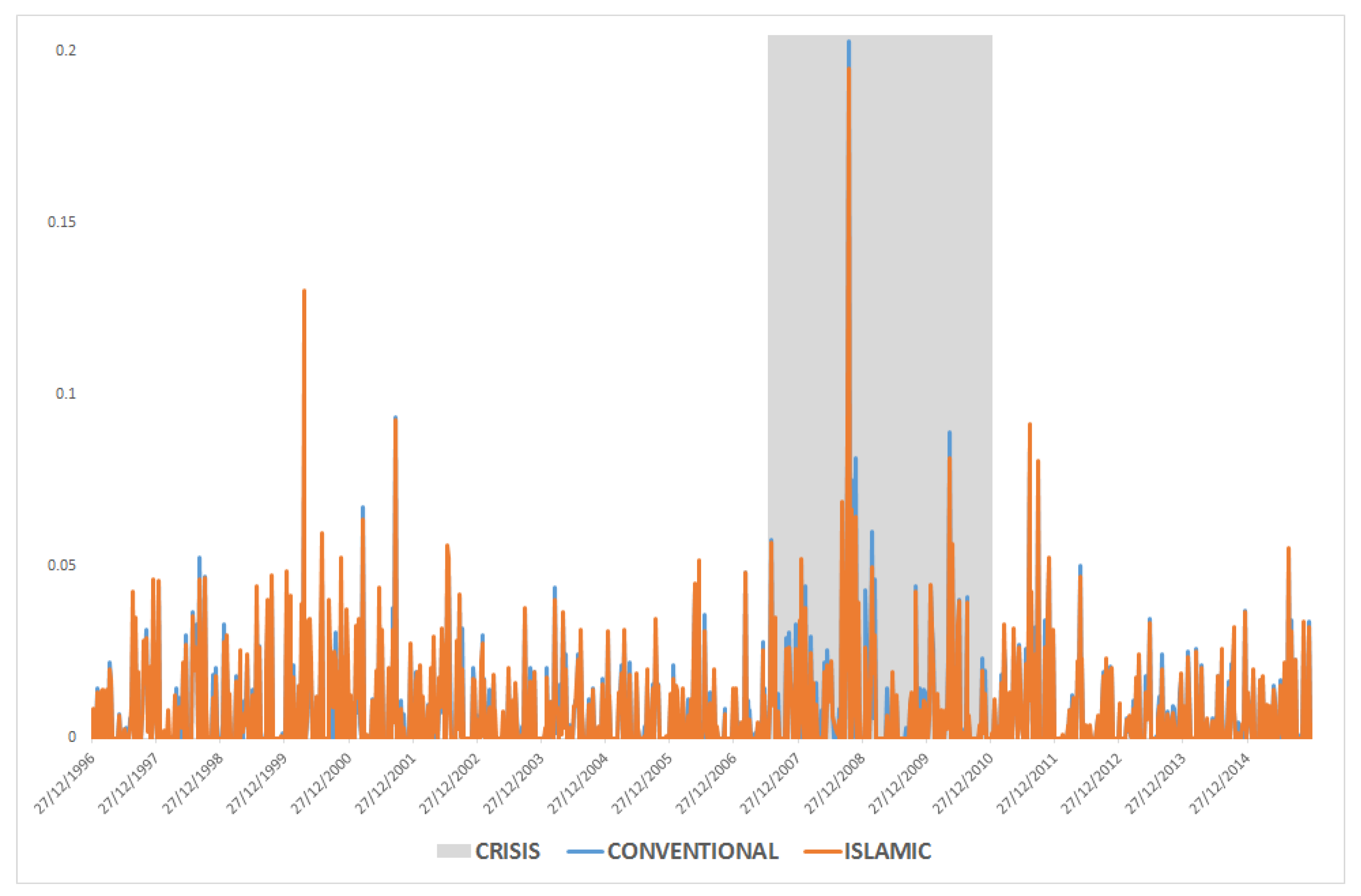

Hence we can expect that over time Shariah-compliant funds may provide better returns than conventional funds due to their socially responsible attrib-utes to the premium valuation of Shariah-compliant assets. The account is introduced following the demand from EPF members to have their EPF account managed and invested according to Shariah principles. The 25 of minimum guaranteed dividend return which applies to the conventional scheme does not apply to Simpanan Shariah.

On Feb 16 the EPF declared a 615 dividend for its conventional portfolio and 59 for Simpanan Shariah way above the speculated low of four plus per cent purportedly on sizeable write-downs given how badly equities performed last year. This is because under Shariah principle EPF is not allowed to make any promise of the gains. Now you might think EPF is only available to those who have employers but thats not true.

Anecdotal evidence from a 10-year track record shows that FBM Shariah had a. All EPF members have an option to convert their Conventional Savings to Simpanan Shariah. Simpanan Shariah will only invest in the Shariah portfolio.

EPF Simpanan Syariah on track to launch on Jan 1 2017 w RM100b initial fund size. According to EPF CEO Datuk Shahril Ridza Ridzuan the Syariah-compliant scheme will outperform conventional ones during poor economic times. To ensure that the Simpanan Shariah is managed in accordance with Shariah as required under section 43A of the EPF Act a Shariah governance framework is established to govern the Shariah compliance aspects of the EPF Simpanan Shariah.

The Employees Provident Fund EPF with the approval of the Minister of Finance today declared a dividend rate of 690 per cent for Simpanan Konvensional 2017 with payout amounting to RM4415 billion. In February the EPF declared its dividends for the year for the first time in two separate streams. Some critics pointed to 2016 when the EPF had a RM818 billion net impairment loss.

In addition equity investments that do not comply with the Shariah screening criteria adopted by the EPFs Shariah Advisory Committee are deemed as Non-Shariah compliant investments such as companies that earn income from Non-Shariah compliant activities and have debt and cash in conventional instruments that exceed the permitted threshold. A 100 Islamic scheme and another that is conventional. KUALA LUMPUR 10 February 2018.

The EPF Act 1991 requires the EPF to pay the dividend for Simpanan Shariah at any rate according to the actual performance of the investment.

6 15 Pct For Conventional Savings 5 9 Pct For Shariah

Quantile Relationship Between Islamic And Non Islamic Equity Markets Sciencedirect

A Comparative Study On The Financial Performance Of Islamic Banks And Conventional Banks In Kenya Semantic Scholar

Investing In Malaysia Financial Freedom Financial Education And Planning Malaysia 39 S Foremost Unit Trust Financial Education Trust Fund Financial Freedom

A Comparative Study On The Financial Performance Of Islamic Banks And Conventional Banks In Kenya Semantic Scholar

A Comparative Study On The Financial Performance Of Islamic Banks And Conventional Banks In Kenya Semantic Scholar

Conventional And Islamic Stock Price Performance An Empirical Investigation Sciencedirect

A Comparative Study On The Financial Performance Of Islamic Banks And Conventional Banks In Kenya Semantic Scholar

A Comparative Study On The Financial Performance Of Islamic Banks And Conventional Banks In Kenya Semantic Scholar

Pin By Adrian Chan On Money Talk Bond Funds Investment Advisor Portfolio Management

A Comparative Study On The Financial Performance Of Islamic Banks And Conventional Banks In Kenya Semantic Scholar

Sustainability Free Full Text Sector Portfolio Performance Comparison Between Islamic And Conventional Stock Markets Html

European Pension Funds And Sustainable Development Trade Offs Between Finance And Responsibility Sievanen 2017 Business Strategy And The Environment Wiley Online Library

Quantile Relationship Between Islamic And Non Islamic Equity Markets Sciencedirect

Epf Dividend Rate For 2019 Is 5 45 For Conventional 5 For Shariah

Transactional Framework For Conventional Purchasing And Payment Procedure Download Scientific Diagram

A Comparative Study On The Financial Performance Of Islamic Banks And Conventional Banks In Kenya Semantic Scholar

Epf Announces 5 2 Dividend For Conventional Accounts 4 9 For Shariah Free Malaysia Today Fmt In 2021 Dividend Accounting Free Online